NestEgg: new features for 2023

NestEgg closed the year, looking forward to 2023. Our User Group of 30+ responsible lenders helped us prioritise the most important new features for Q1/2023.

Ever-conscious of a cost of living crisis that is fast developing into a recession, the focus was supporting responsible lenders to make better decisions in increasingly difficult economic climate.

Making better lending decisions

Although there has been a slight improvement in credit score for credit union loan applicants, the amount requested and levels of debt have increased. These indicators suggest increased pressures on household finances that may manifest into missed payments. The trick will be spotting these warning signs early on.

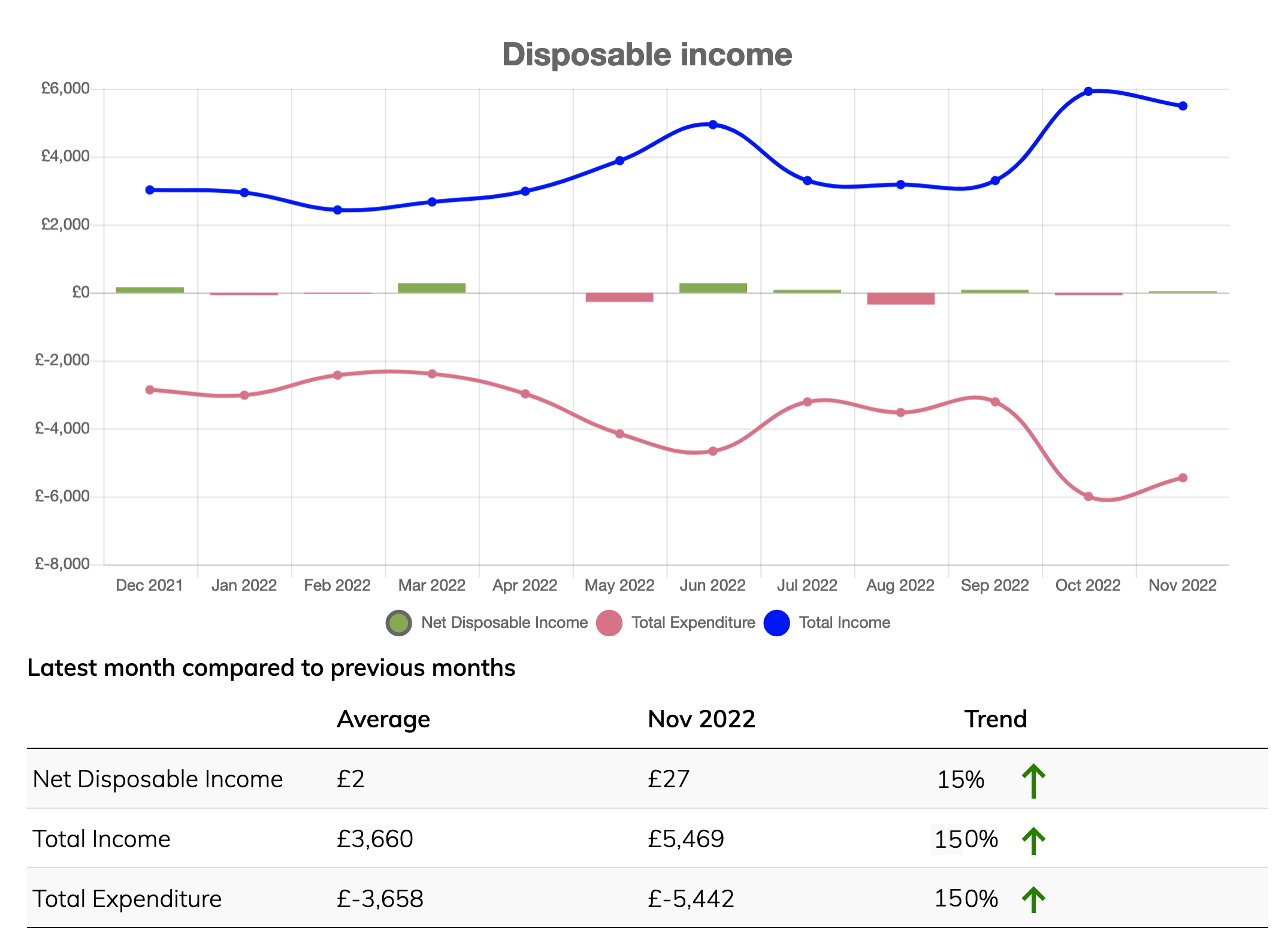

One of the advantages of NestEgg’s decision engine is that open banking information is displayed alongside credit data in one place. The user group looked at new open banking visuals, including one to show disposable income over the previous 12 months, highlighting any changes (positive or negative) in the most recent month. These are all being released over the next few weeks.

Disposable income report

According to StepChange Many households are likely to turn to using credit cards to fund day to day living costs.

For this reason, the balance of all credit cards over the previous 12 months will be shown in the NestEgg decision engine as a chart. These month-to-month balances will be displayed next to the limit. Together with existing debt ratios the decision engine gives a fuller picture of affordability.

Additional assessment options

Soft credit checks

It’s increasingly rare to find lenders requiring new borrowers to undergo a ‘hard’ credit check. Hard checks have a negative impact on an applicant’s credit score. Therefore, an almost without exception, lenders provide a pre-qualification a soft check.

The applicant knows whether they will (or won’t) get the loan they want. Furthermore, if accepted, they can be provided with a credit limit, providing a budget for their proposed spend (e.g. they now have a budget for home improvements, new car or debt consolidation). Most importantly there’s no impact on their credit score (which can tumble when they apply formally for a loan).

When a responsible lender is only offering loan applications using hard credit checks, many applicants will simply walk away. For example we spoke to a credit union member who wanted to borrow £10,000 for home improvements. However he was also about to re-mortgage and didn’t want a hard check, fearing the mortgage offer would be withdrawn. Consequently he looked to get an in-principle yes from another lender.

Furthermore, soft credit checks are a lower cost than their ‘hard’ equivalent. As a result, credit declines are cheaper for lenders.

Open banking only

Most credit unions handle two or more top up loans each year. Every time a member tops up, a credit check maybe carried out. This will reduce credit score. And, of course, lenders pay for each credit check.

NestEgg will be implementing open banking only checks. For example, every second top up could be an open banking only assessment with an option to carry out a credit check, if necessary.

And much more …

These are just some of our forthcoming features. There’s a whole lot more on the way. Mortgage and car loan data sets, advanced analytics, additional integrations and a new service that will help responsible lenders significantly grow their loan books.

Sign up below to keep up to date