On 10 June our webinar looked at lending trends since lockdown. We wanted to find out how Coronavirus affects the financial health of credit union borrowers.

Responsible lenders can adjust their lending to this new reality. At the end of the webinar, and this article, we share two risk-based personas. These are example types of borrower, less adversely impacted by Covid-19.

Loan demand is falling

Almost 40% of people have taken a step back from making financial decisions.

Normally around 7% of the population apply for a loan in any given year. Now just 4.5% of people are planning to submit a loan application in the next 12 months.

Consequently, affordable credit providers are seeing loan applications tumble. In one survey credit unions were seeing a 60% fall in applications. Every credit union NestEgg spoke to said that lending was down by over 10%.

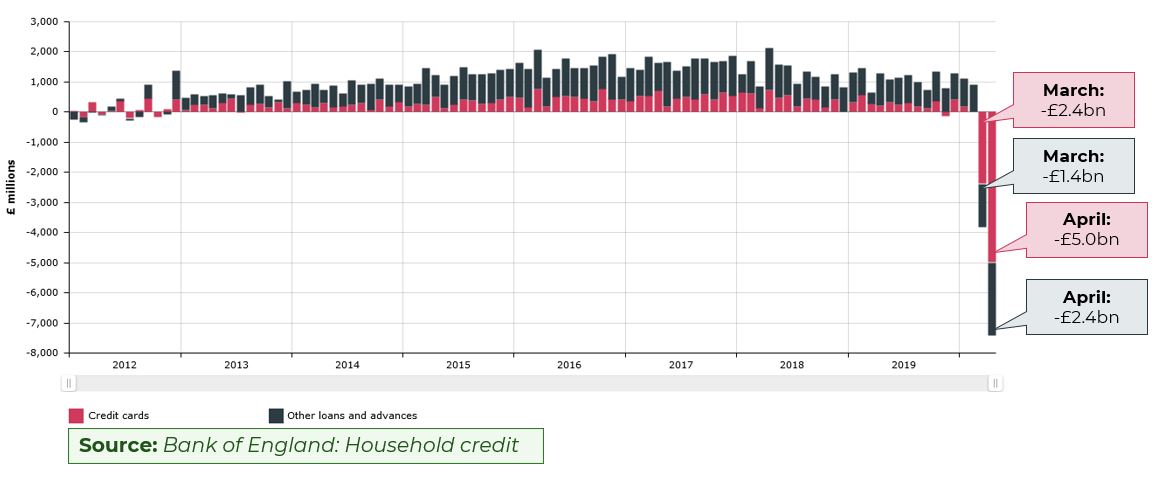

In fact, people are paying down huge amounts of debt.

According to the Bank of England net credit flows for credit cards were minus £7.4bn in March and April; people paid back far more than they borrowed. Balances are being paid off at record levels. £5bn was repaid on ordinary loans during the same period.

Credit bureau and spending data

Repayment holidays are reducing the number of missed payments. With fewer loans being applied for, credit scores are actually improving, albeit slightly.

Open Banking data is showing a shift from spending on ‘wants’ to ‘needs’. That is hardly surprising. Shops and bars are closed. Overall consumption has fallen by half. There’s been a slight fall on spending on credit to around 4% of overall spend. However low-income households are still spending 2% of their income on high cost, short-term credit repayments.

There’s worse to come

Paying down debt and saving more are sensible behaviours in good times. They’re tactics for financial survival during a pandemic. 75% of credit unions we spoke had seen savings rise by more than 10%.

16 June figures from Job Centre Plus show a 25% rise in the number of people claiming out of work benefits to 2.8m people. This is the most dramatic worsening of employment since the Great Depression. March to May saw the biggest decrease in job vacancies since records began.

Wage subsidies prop up 9m jobs. It is likely that unemployment will surge when the Government’s Furlough scheme tapers from October. Bad rates on loans will rise.

But if the response by lenders was just a debt recovery one, loan books would tumble. When the level of bad debt became apparent during the Growth Fund, many credit unions cut back the size of loans they were making. Consequently only smaller sized advances were issued, resulting in higher costs, higher bad debt and lower income. The sector shouldn’t make the same mistake twice.

Not all borrowers will be affected

Workers in the private sector are likely to fare worse than those working in local authorities, the NHS and other public sector roles.

Similarly those on the lowest incomes, who are often out of work, will actually see their incomes increase by around £1,000 per year.

Knowing your customer: using personas

Responsible lenders can use personas to target borrowers less likely to have been impacted, financially, by Covid-19. A persona is a fictional character that can be used to understand a segment of your target audience.

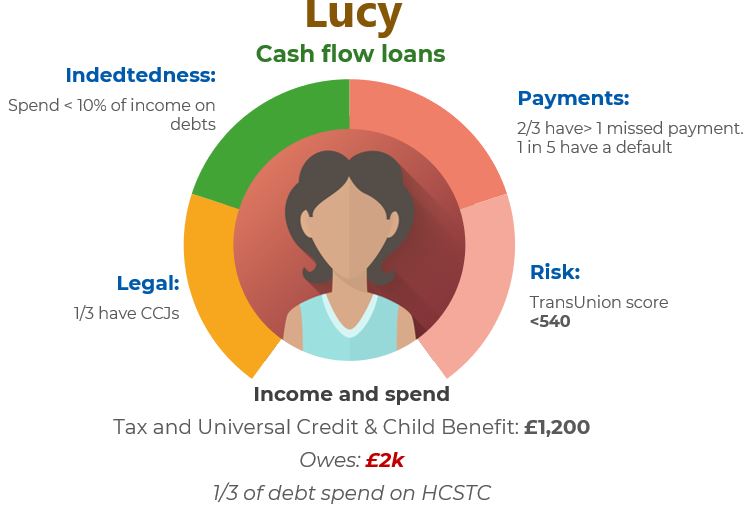

Lucy represents the most typical of credit union borrowers.

Lucy’s main income is benefits of less than £1,200 per month.

Debts are under £2,000. Although 1/3 of that goes on high cost credit.

Lucy’s average credit score is 540. But evidence from responsible lenders shows that low score does not always correlate with higher bad rates.

Repayment history is a risk. 2/3 have missed a payment in the last 12 months. 1 in 5 have a default. These are usually smaller sized debts for catalogues and mobile phones.

Lucy can’t access a lot of credit and so it not over-indebted. Less than 10% of spend goes on credit repayments.

As the main source of income is tax credits, Lucy’s income is likely to increase by around £1,000 per year as a result of government policy to support people during Covid-19.

A balanced portfolio where larger loans cross subsidise smaller advances, means lending to people still in work. With Covid-19 putting so many jobs at risk, this may mean focussing on public sector workers.

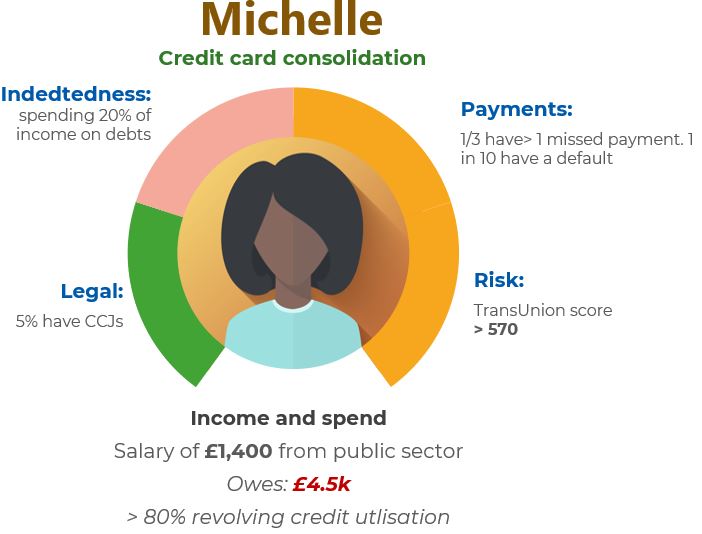

Michelle represents this kind of persona.

Whilst the credit score is higher than Lucy; it is still fairly low; probably because she’s spending to 80% of limits on credit cards.

But this is also the reason for her application.

Credit card consolidation is the highest credit score by application purpose going through the NestEgg decision engine.

Michelle is up to date with most payments.

But she does spend 20% of her monthly income repaying credit.

Few Michelles have County Court Judgments.

The average income is £1,400 but Michelle owes twice as much as Lucy.

Nevertheless helping people pay down debt (as per our earlier findings) is a real opportunity.

And its likely Michelle will have a job to go to after the Furlough scheme ends.

Watch the webinar

You can watch the recording of the webinar right here…

Sign-up to our email newsletter below 👇 to be among the first to get our latest research and other insights into responsible lending. And don’t forget to follow us on LinkedIn

Book a demo now

Get insights into responsible lending

Enter your email to get insights once or twice a month

No spam. Unsubscribe anytime.