A Debt Relief Order (DRO) is a formal debt remedy. A DRO is an alternative to bankruptcy that is designed for people who cannot afford to pay off their debts. DROs can offer a fresh start to those who are struggling with unmanageable debt.

How it works

DROs are for people with lower levels of debt and few assets. They work by ‘freezing’ an individual’s debt for 12 months. After the 12 months, the debts included in the DRO are written off if circumstances have not changed.

Do you qualify?

People need to apply through an approved debt adviser and have to meet certain eligibility criteria:

- Must have a low income

- Any surplus income must be less than £75 per month

- You can’t have any savings or assets worth more than £2,000, although the maximum value of a motor vehicle increases to £4,000 from 28 June 2024

- Debts must be £30,000 or less (this increases to £50,000 on 28 June 2024)

- Applicants must have lived or worked in England or Wales in the last 3 years

You cannot apply if:

- You are a homeowner

- You have a Bankruptcy Restriction Order or Undertaking

- Creditors have applied for bankruptcy but the hearing hasn’t yet taken place

- You have petitioned for bankruptcy but the petition has not yet been dealt with

- You are currently bankrupt or in an Individual Voluntary Arrangement

- You have had a DRO in the last six years

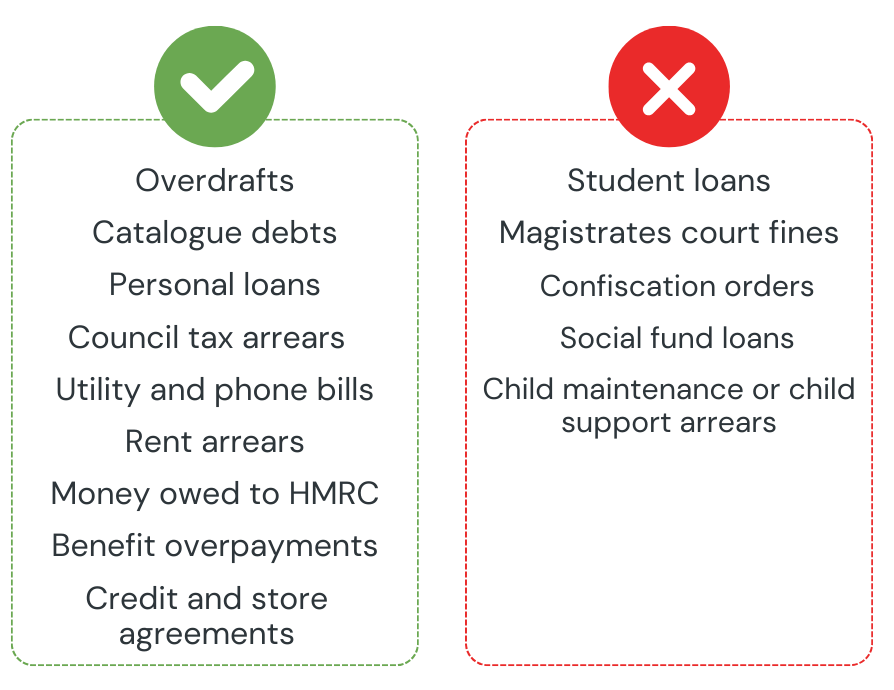

What debts can a DRO be used for?

The debts that are eligible for debt relief orders are referred to as ‘qualifying debts.’

Table information taken from Money Helper.

How to apply for a debt relief order

DROs must be applied through an approved debt advisor, who are also known as an ‘intermediary.’ There is no longer an administration fee, so the application is free. Seek free debt advice to find out more.

Things to consider

Remember:

- Not all debts will qualify

- There will be a negative n impact on your credit score

- The DRO will remain on a credit file for six years

Always seek advice from a free debt service like Money Helper to explore all potential debt management options.

Important note: NestEgg is not a provider of financial or money advice. Tips and content are provided on a general guidance basis. NestEgg assumes no responsibility or liability for any errors or omissions in the content on this site. The information contained in this site is provided on an “as is” basis with no guarantees of completeness, accuracy, usefulness or timeliness.

Boost your chances of getting an affordable loan

Enter your email to get tips once or twice a month

No spam. Unsubscribe anytime.