NestEgg is now able to provide credit unions with detailed risk analyses to optimise loan performance. Based on what we’ve seen, here are five ways to reduce bad debt.

Watch those debt ratios

Applicants with high credit card balances (using more than 75% of their limits) are the most likely to miss payments on credit union loans. Additionally, borrowers spending over 25% of their monthly income paying back credit are more likely to default.

The electoral roll remains important

In a digital world, Electoral Roll information feels out of date. In fact, it’s often updated only annually. Despite this, 8 in every 100 people who are not registered to vote will default on a credit union loan at some point.

Loan purpose matters

Loan purpose drives bad debt. However, not in ways that might be expected. Home Improvement loans have some of the lowest rates of default for all credit union lending. On the other hand, emergency loans have the highest rate of defaults.

Consolidation loans have a high rate of missed payments. However, these missed payments do not always translate into defaults. In fact, consolidation loans are some of the most recoverable from delinquency, provided a timely intervention is put in place. How does loan purpose affect delinquency in your credit union? You might be surprised by the results:

Intervene early to prevent defaults

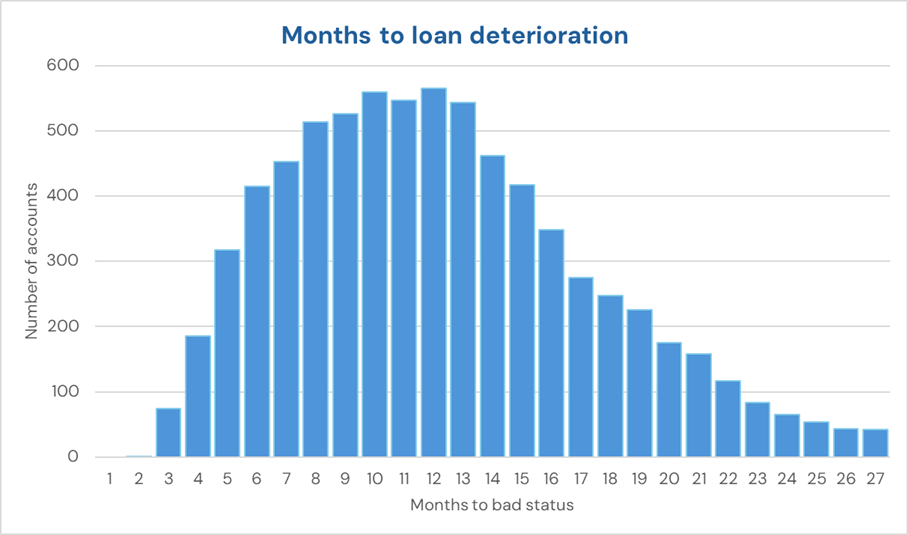

The chart below shows borrowers beginning to miss payments from 6 months of the issue date. Most conversions to bad status (three missed payments or more) happen between month 7 and 13. ‘Affordability interventions’ six months after a loan has been issued have been proven to reduce defaults. However, there is wide variation between products and credit unions.

What’s the best point of intervention for your credit union?

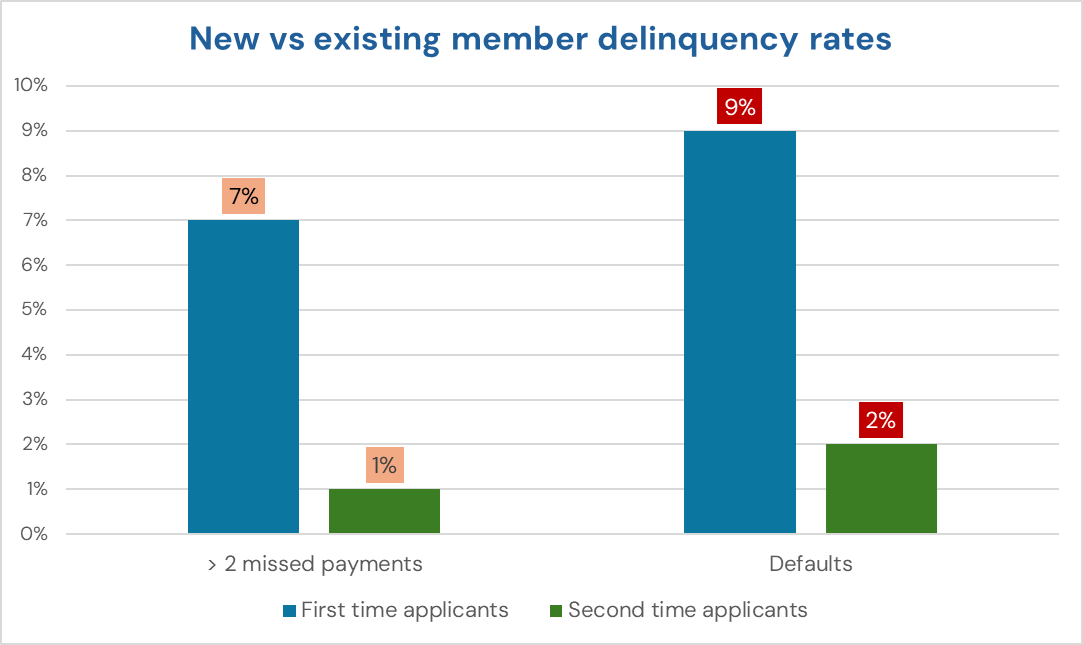

Reward existing members

Existing members repay better. This can be significant. In some cases, the default rate for new members is more than four times higher vs existing borrowers. Existing member loans perform better, especially when Save as You Borrow is an option. As a result, incentives, such as lower rates, represent a risk-based way to reward loyalty.

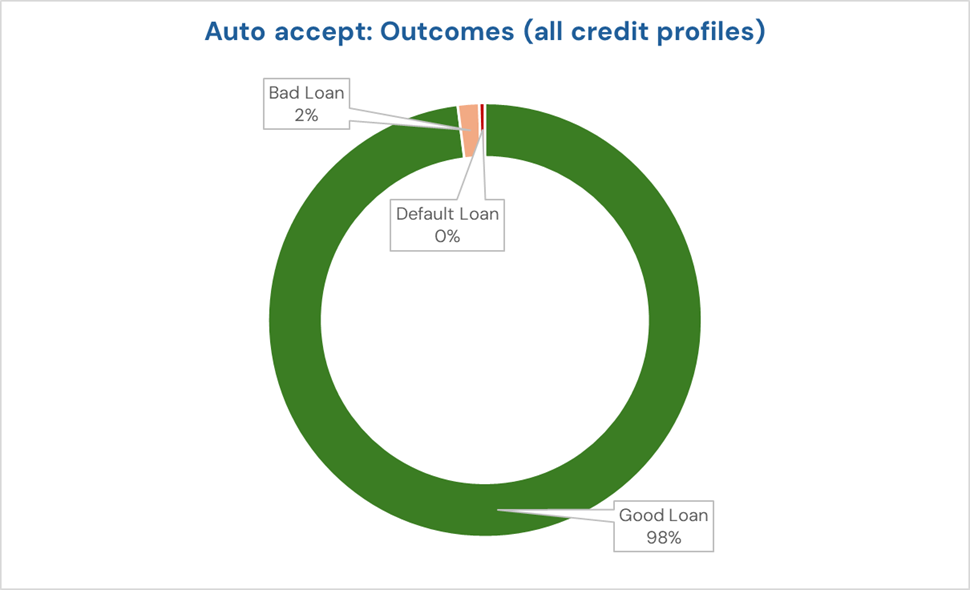

Trusting automation is the key to growth

The default rate on recommended accepted loan applications from NestEgg is close to 0% in most cases. Fewer than 2% of loans will experience missed payments. Importantly, there is sufficient data to align this to a specific credit union’s risk appetite.

Within the UK, the fastest growing credit unions are turning most loans around within four hours. Without automation this simply isn’t possible at the scale required to achieve true sustainability.

Grow your loan book

These are just some of the strategies to balance risk and reward and keep arrears within budget. All lenders using NestEgg have the ability to track the performance of loans that have been through the Decision Engine.

Whether you’re already working with NestEgg or exploring automation for the first time, our Lending Risk Insights and Decision Engine give you the tools to lend smarter and grow sustainably.

Book a demo or get in touch to discover how NestEgg can help your credit union reduce bad debt, boost growth, and unlock new opportunities.

Book a demo now

Get insights into responsible lending

Enter your email to get insights once or twice a month

No spam. Unsubscribe anytime.