NestEgg is delighted to announce its participation in the FCA Financial Inclusion TechSprint. The TechSprint aims to utilise technology to boost the chances of loan approval and foster financial inclusion.

The problem

Our participation addresses two sides to the challenge. Firstly, people need help to find an alternative lender that is more likely to accept their loan application. The second challenge relates to more effective use of data for credit assessment.

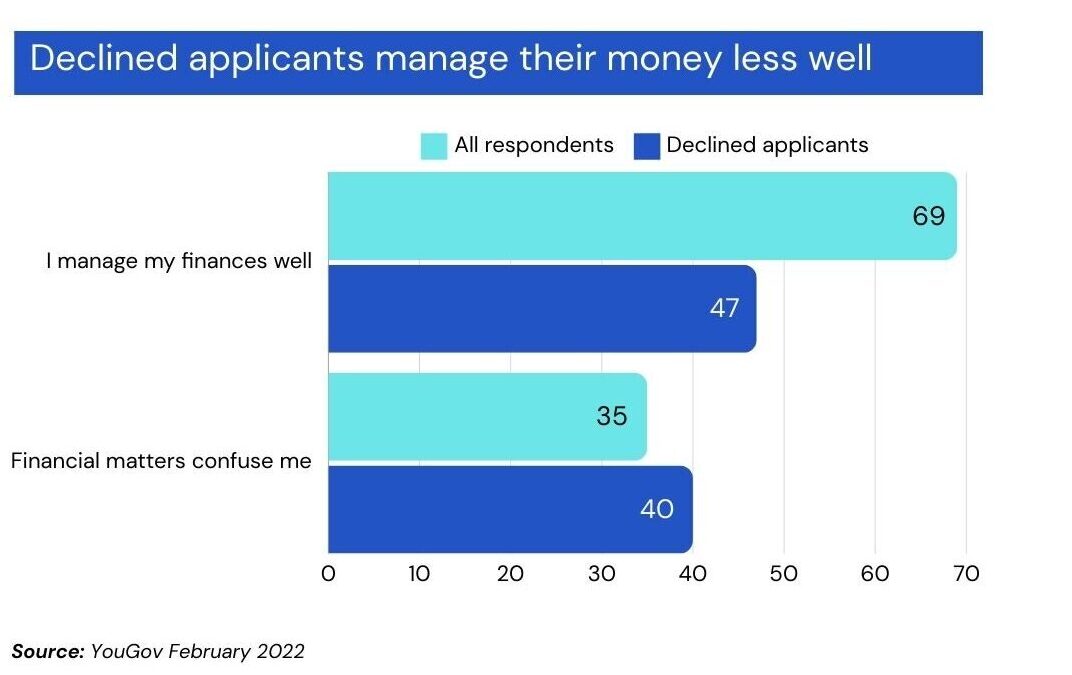

According to the Money Advice Service, in the year to April 2023, 1 in 5 people were declined for credit. That’s 9 million people. Furthermore, 5% of applicants were declined four or more times. YouGov found that people who are declined are 20% less likely to manage their finances well. Half of people being turned down stated that money confuses them.

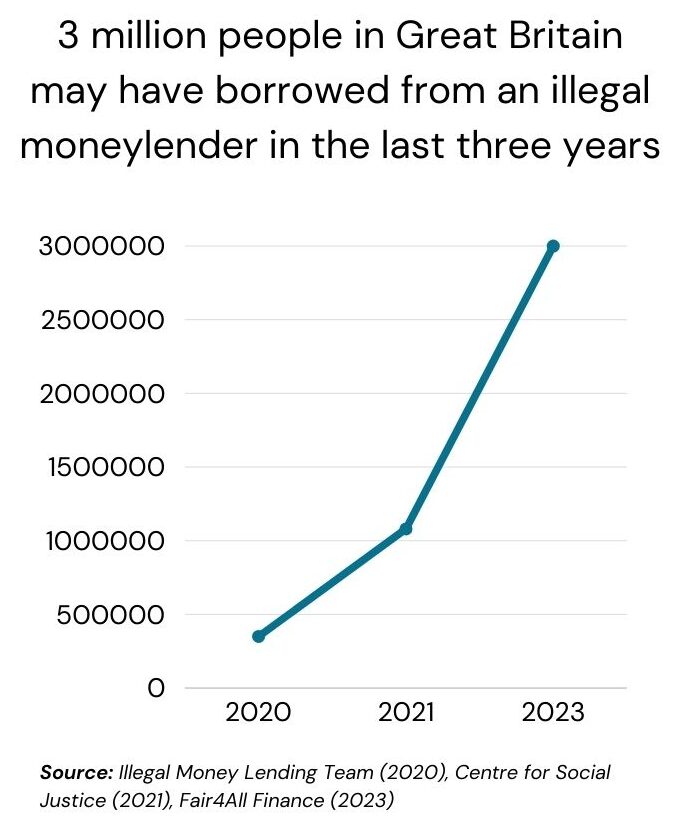

The consequence of a lack of access to affordable credit is identified in data from the Illegal Money Lending Team (2020), Centre for Social Justice (2021), Fair4All Finance (2023). This data suggests that 3 million people used an illegal money lender in 2023. Worryingly, this is up from 500,000 in 2020.

In relation to decisioning, The FCA’s 2022 Interim Report on Failures in the Credit Information Market found that harm resulted from the use of insufficient credit data.

This market failure means people are more likely to get a poor deal; costing money and time and making it harder for people to meet financial goals.The report revealed limited integration of data sources. Our involvement in the TechSprint will serve as a crucial solution, emphasising that: “The use of wider variety of data in decision making should increase the overall quality of lending decisions.”

The NestEgg platform

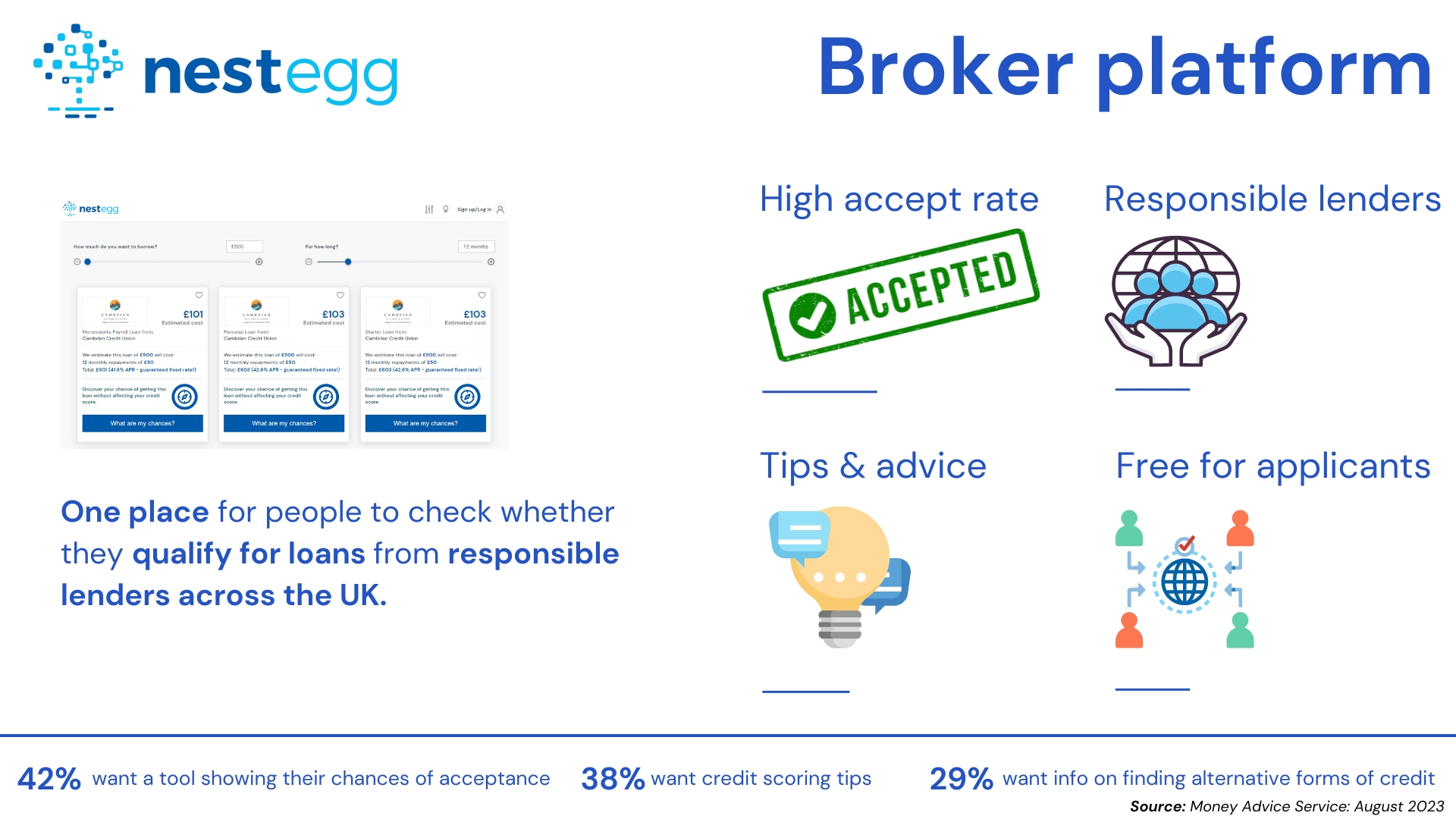

NestEgg saves lower income households money by helping them find alternatives to High-Cost Short-Term Credit and, increasingly, illegal money lenders. This is achieved through better referral to responsible lenders, using a new broker platform. Credit union lenders use a wider set of data for even fairer lending decisions. Before applying on the platform, an applicant can ‘check their chances’ with a soft credit check to see whether a lender would be likely to accept their application. An applicant can choose to submit their application, check other lenders’ products or save their application for later. If someone is declined, NestEgg explains what this means, why it’s important and what can (or can’t) be done about it. After following tips, over time, declined applicants are more likely to accepted for loans in the future or access a debt remedy.

On the decisioning (lender) side of the platform, NestEgg is using an increasingly varied dataset to help responsible lenders fairly decision loans. This data can help turn more loans that would have been declined into acceptances. To ensure a rounder view of loan applicants, NestEgg continues to develop its software to provide decisions that combine open banking and credit data and soon insight into credit card behaviours, details of assets and the direction financial health is taking.

Importantly, NestEgg’s Decision Engine knows why a loan is declined. Because of this, tips are specific and relevant to the borrower. As a result, applicants are more likely to take the required actions. Following this, their credit profile visibly improves and they’re more likely to be accepted for loans.

Inclusion

For every £10 million of loans advanced, lenders on our platform can save borrowers £1.2 million in excess interest. After two years of membership of a credit union, an individual will have saved 20p for every £1 borrowed, rising to 60p after five years. The Broker platform will benefit people with lower credit scores. Currently 2/3 of people will have a TransUnion credit score that is poor or very poor. Furthermore, six in ten beneficiaries will live in the top 20% most deprived wards in the UK. 90% of households will have an income below national median pay. Two-thirds will be women.

Innovation gap

For the borrower facing proposition, other broker platforms only offer very limited access to responsible lenders. Because of this, applicants on these platforms with poorer credit scores are more likely to be referred to a high-cost lender. This entrenches financial exclusion. Current solutions fail to offer advice and tips on securing acceptance from a responsible lender. Unique decisioning criteria for each responsible lender isn’t available elsewhere.

When data is siloed, it is difficult for lenders to make quick and fair decisions. Consequently, firms have to look in several places for information. Because of this, lenders will typically rely on credit data alone. This is a narrow historical and already dated view of an individual’s lending risk. As a result, decisions aren’t sufficiently aligned with the real circumstances of the borrower nor the risk appetite of the lender. More people are declined who may otherwise be good payers, or, worse still, loans are made to those who cannot afford them.

TechSprint

Our focus will be on developing our platform to improve support for vulnerable and financially excluded individuals. Enhancing the user experience to ensure informed consent and encourage people, where possible, to identify as vulnerable are key objectives. More informed decisions based on wider data sets can help increase accept rates and identify those for whom a debt remedy is a better option.

During March we are on-boarding lenders with an initial emphasis on the North West and Wales. We’ll start a pilot project with referrals from a bank and other problem spotters in April. Between now and May the TechSprint will put us in touch with experts to help us improve our platform in time for a demo day in Glasgow on the 30th of May 2024.

Get involved

- Lenders: Responsible lenders can join the broker platform on a flexible basis. Only loans with a high chance of being accepted are referred to each lender. There are no on-boarding fees. Set up is easy and there’s no need to use NestEgg Decision Engine. Lenders can configure products and put them live within minutes.

- Referral organisations: Organisations working to promote financial inclusion can refer to the broker platform. There’s no charge for sending applications to NestEgg. We can provide analytics to demonstrate the benefit and improved outcomes as a result of participation.

Book a demo now

Get insights into responsible lending

Enter your email to get insights once or twice a month

No spam. Unsubscribe anytime.