Hiding in plain site among Silicon Valley’s hallowed circles of so-called growth hackers is a concept that’s become known as the fundamental growth equation.

A growth equation is a simple formula. It represents the key factors that combine to drive your growth – your core growth levers. This equation is different for every product or business.

For example for eBay the formula is:

NUMBER OF SELLERS LISTING ITEMS x NUMBER OF LISTED ITEMS x NUMBER OF BUYERS x NUMBER OF SUCCESSFUL TRANSACTIONS = GROSS MERCHANDISE VOLUME GROWTH

Your Growth Equation

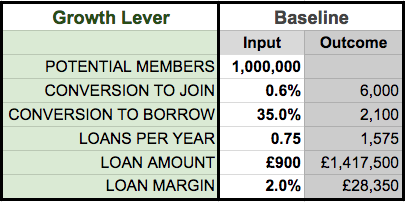

Here’s a simplified growth equation for a credit union’s loan book:

Assumptions:

- Potential Members: the total number of people who are eligible to join based on common bond

- Conversion to Join: the percentage of people who have joined the credit union of those eligible to join

- Conversion to Borrow: the percentage of members who are borrowing at least once per year

- Loans Per Year: the average number of loans taken per member over a given period, say annually

- Loan Amount: the average amount borrowed per loan

- Loan Margin: the average gross profit per loan taking into account factors such as APR, default rates, assessment costs, general overhead, admin costs and cost of money

Note that the growth equation is not intended to be precise mathematical equation but rather a means of teasing out your core growth levers.

Of course there are many of factors that are common to growing all businesses. The emphasis here is to identify the unique and most important levers that are specific to the growth of your business or product.

The formula you arrive at should be simple and reflect the essence of what drives growth for you. This approach avoids the trap of data overload and allows you and your team to focus on what matters most.

The North Star

Choosing the one key metric of ultimate success will help you to hone your growth equation and narrow your focus to give you the best chance of achieving your goal.

We call this one metric that matters above all else, the North Star.

As a guide, your North Star should be the factor that most closely aligns with the value you create for your members or customers.

As a guide, your North Star should be the factor that most closely aligns with the value you create for your members or customers.

Ask yourself which variable in your growth equation best represents the delivery of the most compelling experience for your members and potential members.

For WhatsApp, the compelling experience for its users is the ability to send unlimited messages to friends and family anywhere in the world for free.

Their North Star was therefore the number of messages sent rather than say, daily active users. This is because if the user is sending just one message a day, it’s unlikely that WhatsApp is their preferred way to communicate with their network. Daily active users therefore doesn’t represent delivery of the core value to users.

Similarly for a credit union, if a member is active but only taking a single loan per year then perhaps Average Loans Per Year would be a better measure.

Also note that your North Star may change over time as you progress. For example, as Facebook learned how to engage users more actively, they replaced their initial metric of monthly active users with daily active users.

Putting the Growth Equation to work

As the old adage goes,

if you can’t measure it, you can’t manage it.

And if you can’t manage it, you can’t improve it.

There’s no point in identifying your key levers of growth and your North Star unless you measure how they’re performing!

Let’s look at what this might look like for some of the key factors in our credit union growth equation.

- Conversion to Join: For each new member acquired… Where do they come from? Who’s discovering you through which partner websites? Via word-of-mouth referral? Google search? Your email newsletters? Online / offline ads?

- Conversion to Borrow: For each borrowing member… How many applicants are put off from even starting an application because they have to download a form, print it off, fill it out, find an envelope, buy a stamp and take it to a post box? Same with bank statements and utility bills? Which channels deliver your most active borrowing members?

- Average Loan Margin: How much time and money is it costing you to assess each loan application? To review each bank statement? To check out each utility bill to establish an identity? What’s the opportunity cost of all those people who decided it was too much bother to apply, or those who started but dropped out because it was too much hassle?

Tracking ‘supporting’ metrics like these is the key to measuring progress on the top-line levers like Conversion to Borrow.

An example

Here’s an example showing made-up ‘baseline’ figures for each growth lever:

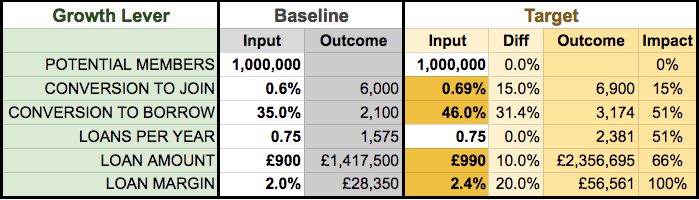

Let’s say, a key company goal is to grow the amount loaned out over the next year by two thirds and double total gross margins. Using our growth levers we can see that we can hit our goal by increasing four levers:

- Conversion to Join from 0.6% to 0.69%

- Conversion to Borrow from 35% to 46%

- Loan Amount from £900 to £990

- Loan Margin from 2% to 2.4%

There are many combinations of growth lever targets that will reach our goal.

The point of the exercise here is to make it easy to play around with ‘What If’ questions to arrive at a tough but achievable objective. In this example we have four targets to aim for but it could just as easily be a single factor. Either way, we end up with a clear target to focus on.

Unlocking actionable insights

Knowing what’s working and what isn’t, uncovers insights that allow us to try new things and move the needle on what matters most.

Another powerful way to unlock actionable insights is to look for clusters of unexpected behaviour of members across the factors on your growth equation. For example, you may find that members acquired via Facebook tend to be younger, apply for more loans but fail to complete as many applications as older members.

Segmenting your members can reveal all kinds of opportunities to improve the Joining and / Borrowing conversion rates for example.

Common ways to segment members are by marketing channel, mobile vs desktop. Or by those visiting a specific page, viewing a specific video or signing up for an email newsletter.

What your Growth Equation can do for you

Frankly there are two alternatives to not taking a strategic approach to growth:

- A slow certain death: as your team drain your organisation’s precious resources by thrashing about in the dark, chasing random tactics and the latest shiny tools.

- An inevitable slide into irrelevance: as you pretend your members’ and potential members’ expectations are stuck in the last century before the advent of the internet, Amazon, Netflix and Uber.

*****

On the other hand, coming up with and putting your growth equation and North Star to work will help you:

- Uncover the major drivers to grow your loan book and your member-base

- Determine your baseline numbers & measure progress

- Align your teams, focus and prioritise their work

- Design growth experiments & measure the results

- Prioritise effort on the highest impact area

- Create better forecasting

Ultimately, your growth equation will give you a solid basis to grow your loan book, pay out higher dividends and attract more members on a measurable, predictable and sustainable basis.

Book a demo now

Get insights into responsible lending

Enter your email to get insights once or twice a month

No spam. Unsubscribe anytime.