Good Loan Applicants Are Being Turned Away

4.5 million people were declined for credit last year. Many for good reason; 1/4 of applicants were in financial difficulty. 10% were ‘just surviving’.

However 42% were what the Financial Conduct Authority calls ‘financially resilient’. These applicants have savings, insurance and a pension. 7% had assets of £50,000. 8% earn more than £50,000.

One in five are put off applying for credit, because they thought their application would be rejected

People are missing out. Lenders are losing income.

Simple credit scoring leaves people behind. Not all lenders report to a credit bureau. A house or job move drives down scores as will taking out a loan.

By definition the financially resilient are likely to be able to afford credit; it is the eccentricities of credit scoring that are letting everyone down.

What you can do

Credit scoring complementing affordability checking (rather than the other way around) enables you to deploy the following strategies:

- Ask the applicant if they are financially resilient e.g. “do you have a savings account and / or pension.

- Use Current Account Turnover data from a credit bureau. Most current accounts are reported and the data can verify how much money is being paid into that account, on average, every month.

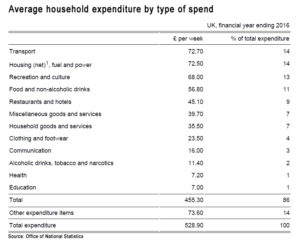

- Assess a couple of items of expenditure, e.g. food bills, against the Office of National Statistics Living Costs and Food Survey. The average UK household spends £57 per week on food and non-alcoholic drinks. If you have an applicant on average income how does this compare?

- Review debt ratios. The average UK household spends less than 10% of monthly income on unsecured debt. If someone is spending more than 1/3 of their monthly income on credit repayments is that too much?

- The debt of half of UK households is equivalent to three months income. One in ten households have a debt to income ratio of more than 80%. Is an applicant’s debt burden too high if their non-mortgage debt is greater than 10 months income?

- Use transaction data, for example from bank or credit card statements. Gathering paper-based statements can put applicants off. This takes time and effort, but help is just around the corner. From 2018 the Open Bank project will enable 3rd parties to access current account and credit card statements online.

But keep things brief. 2/3 of applicants are using their mobile phone to apply because they want to save time; balance information requests with the ability to complete an application quickly.

To avoid missing out on more insights into good lending practice and how OpenBanking can help lenders, please enter your email below.