Credit unions and the Consumer Duty

The new FCA Consumer Duty requires a shift in practice by many lenders. Mutuals, including credit unions, on the other hand have a head start. Their commitment to member service rather than consumer sales means it is easier to meet the overriding objective of the Duty; to deliver good outcomes for members.

Furthermore, credit unions are legally obliged to “create sources of credit for the benefit of Members at a fair and reasonable rate of interest.” In other words, the consumer duty is built into the DNA of a credit union.

NestEgg’s platform makes it easier than ever to access these responsible lenders.

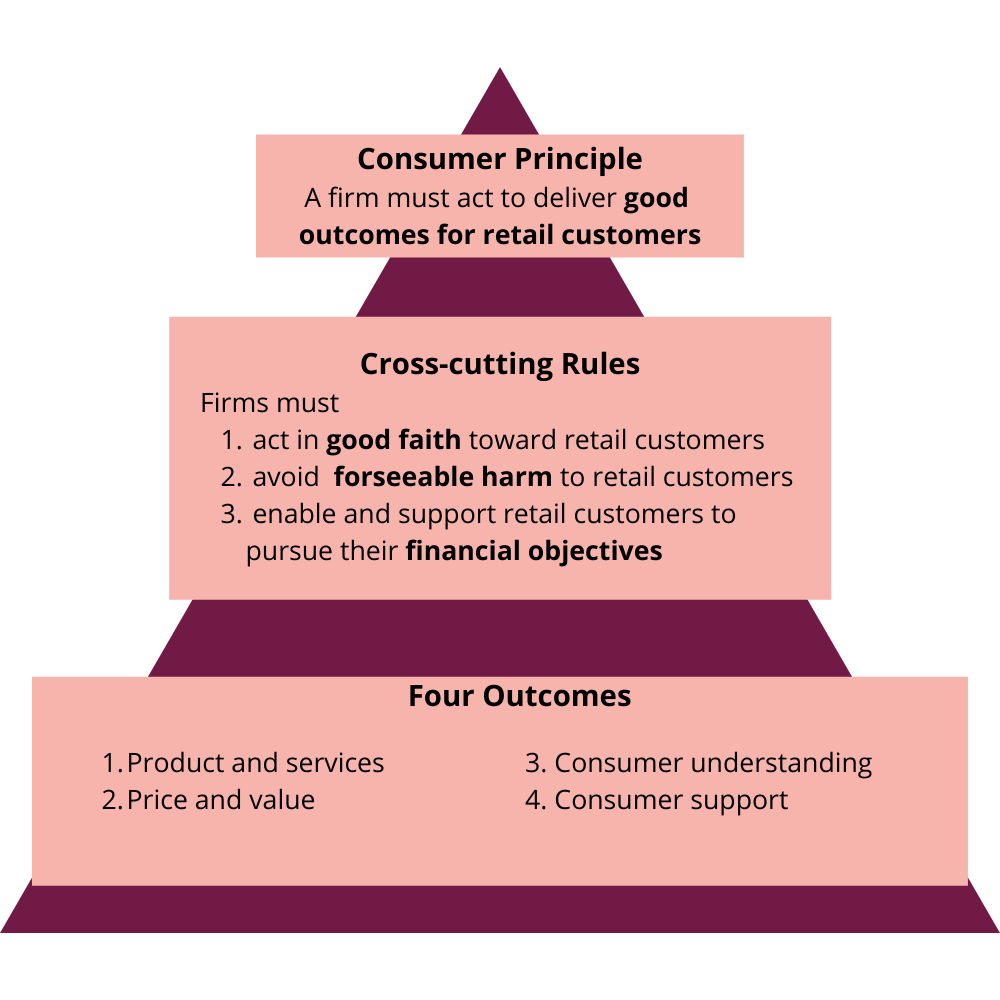

Three cross cutting rules

Additionally, the Consumer Duty has three cross cutting rules. These require lenders to:

- Act in good faith by being honest and open with members. Importantly, credit union loan products have no hidden fees. In fact, the interest rate quoted is what a member will get. There’s no representative APR that only half of applicants might get.

- Avoid foreseeable harm. This means ensuring members can easily exit a contract and that products are priced appropriately. Credit union members can cancel a product without penalty. Uniquely, their interest rates are capped by the UK government.

- Support members to pursue their financial objectives. Members have told NestEgg that their ultimate goal is to borrow less and save more. Credit unions’ Save as You Borrow schemes are where a proportion of the loan repayment is allocated to a savings account. However, these savings cannot be accessed until the loan is repaid. Consequently, the need to borrow in the future reduces.

Research into these products by Fair4All Finance and the Swoboda Centre found that 7 out of 10 borrowers agreed that this type of lending helped them to save more regularly

For example with one of our partner landers, once a member has been with the Credit Union for 2 years, their savings to loan ratio is 20p for every £1 borrowed. Members with five years’ membership have 45p in savings for every £1 borrowed.

There should be four outcomes:

- Design of products and services must meet member needs. One of the big benefits about credit union loans is that members can pay directly from their benefit or salary. In a recent survey. borrowers told Fair4All Finance that they felt more confident about managing their money. Satisfaction levels were 95%

- Price and value. A £500 loan from a high cost, short-term lender can cost 1.65 times the amount borrowed. A credit union loan costs 1.15 times the amount borrowed. As a result, every year lenders using the NestEgg platform save their borrowers £50m in excess interest payments.

- Consumer understanding. Credit unions know their members. Drawn from local communities, credit unions are based on a common bond which binds members together through shared history and experience. People running credit unions are credit union members.

Nazik told NestEgg that her “Credit Union understood my problem with rent arrears. They gave me a loan when I needed it most. Now I have a savings account for the first time in my life.”

- Customer support. Our credit union partners run a range of activities to support their members. Online money tips help people manage their cash and maximise their income. There are financial education workshops, food saver clubs and even a community garden.

“Not only did [the Credit Union] provide me with a loan”, Chris told NestEgg, “they phoned me up to check I was OK a few days later. They are a real life saver.”

NestEgg’s platform makes it easier than ever to access responsible lenders. If you work with vulnerable or financially excluded people, the platform is a great way to improve their financial wellbeing and prevent harm. The service is free to use for referring organisations and their clients, members or customers.