Lending strategy

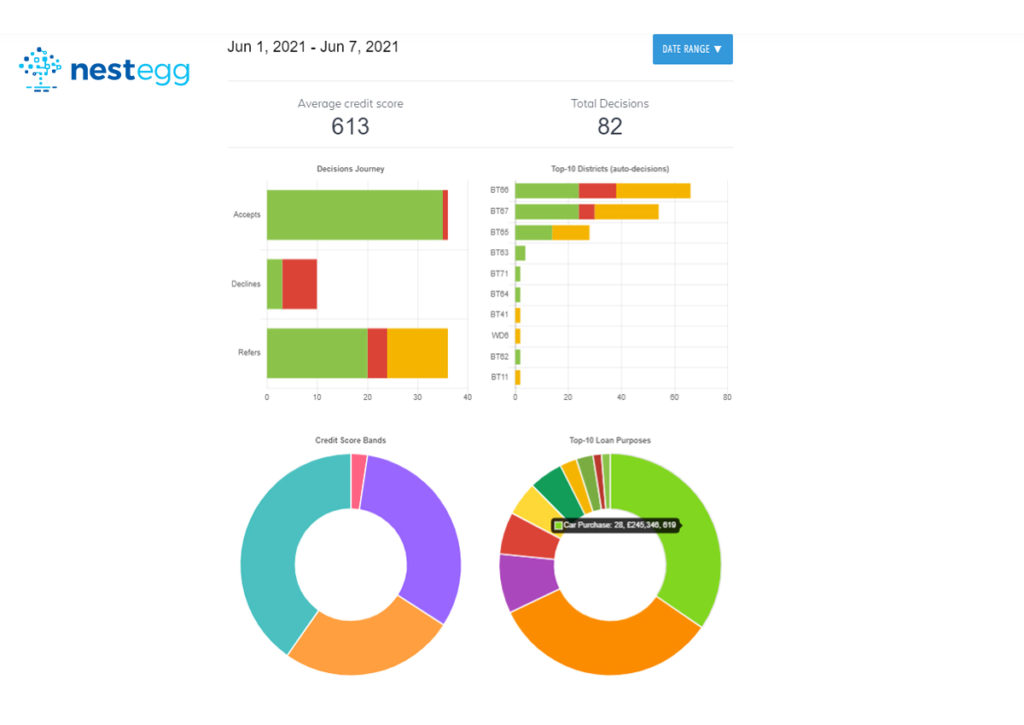

Automated decisions you can trust

Getting automated decisions you can trust is a big challenge. If automated decisions are always subject to review, then cost savings aren’t being realised. Loans will take longer to turn around. Consequently, members become dissatisfied. Furthermore, automation needs to ensure applicants get a fair hearing. The latest version of our decision engine delivers a greater…

Read MoreFaster growth with easy online applications

Covid-19 has been a catalyst for change. A huge global nudge in the direction of doing things online. Because of this, borrowers expect easy online applications. Get this right and loan books grow. Get this wrong and 58% of people will never use your services again. Worse still, 6 in 10 of 25 – 34…

Read MoreHow to improve affordability assessment

40 credit unions attended our recent training: ‘Affordable or vulnerable’ where we looked at how to improve affordability assessment. We addressed a key challenge: Covid-19 and FCA regulations mean affordability is THE issue for 2021. Get this wrong and arrears increase. Non-compliance may lead to complaints. These may arrive via Claims Management Company looking for…

Read MoreAn increase in credit union lending?

It’s too early to establish a trend when you’re looking at just a couple of months’ worth of data. Nevertheless, since March there’s been a definite increase in credit union lending. And it’s a much needed increase. At the beginning of the pandemic Carnegie UK and Community Finance Solutions found that the volume of credit…

Read MoreAffordable or vulnerable? FREE loan affordability assessment training

Covid-19 has made loan affordability assessment much harder. Furthermore, according to the Financial Conduct Authority, 53% of the UK adult population are showing signs of financial vulnerability. NestEgg’s FREE training session will help loans officers strike the right balance between affordability and vulnerability. During this one-hour course, we’ll look at how credit and open banking…

Read MoreAn upgraded decision engine for responsible lenders

A Decision Engine for responsible lenders is only as good as its rules. If rules for deciding whether loans should be accepted, declined or referred don’t align with loans officer thinking, buy-in for automation may be limited. If lending strategies don’t align to lending policies, credit governance will be weak. We’ve been reviewing automated decisioning…

Read More