How NestEgg helped UK Midlands-based Castle & Crystal Credit Union...

September 2018

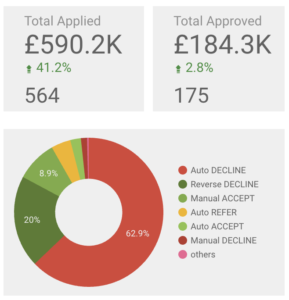

Rolled out mobile-first online loan applications using the NestEgg Workflow to seamlessly feed to the Decision Engine

September 2018

114%

Increase in loans approved to new members in Q4 2018 vs Q4 2017

"Unbelievable... our first 'accept' done & loan agreement signed within minutes !!! ... amazing!"

Dharminder Dhaliwal, Finance & Business Manager

"After going live in Sept 18, 75% of our lending went to low risk, high value applicants"

Dharminder Dhaliwal, Finance & Business Manager

"A bank ownership and ID check, for less than £1, has saved us from a £2,500 loss"

Dharminder Dhaliwal, Finance & Business Manager

%

Decisons now online

Integration of the NestEgg Decision Engine with the new website means applicants can get a decision within 2 minutes.

"If current momentum on our website continues, we will have to put SOLD OUT across our website"

Dharminder Dhaliwal, Finance & Business Manager

NestEgg rebuilt the entire website to optimise the attraction & retention of visitors who overwhelmingly prefer to use a mobile device. 80% of website visitors used a mobile device in Q4 2018.

Tracking search terms, visitor traffic, and behaviour on the new website is a required first step to boosting traffic, membership & loans on an intentional and targeted basis. Before the new website the credit union had no idea where its website visitors were coming from.

%

The overall reduction in bounce* rate on the new website from day 1 (*bounce rate = when a visitor only visits a single web page)

Making it simple for the credit union to produce and promote regular articles on money-saving tips makes the website show up in organic searches (better SEO), raise awareness of the credit union and earn trust over time.

%

Increase in the average number of website pages visited per visit: Q4 2018 vs previous year

Distributing news and relevant content to members and prospective members via email on a tracked, personalised & transparent basis. The credit union now operates a largely automated system for turning website visitors into potential borrowers and savers via email.

Castle & Crystal are now raising awareness with prospective members, influencers and existing members via targeted social media ads based on location, interests and behaviour on the website and over email. Social media is already driving a third of website visits and loan applications.

%

Online applications on a mobile

"I used to moan about not having enough loans…. not anymore! And we know what has come in before we check the applications via the analytics ... the best thing since sliced bread"

Dharminder Dhaliwal, Finance & Business Manager