Is the cost of living crisis making lending decisions harder?

Are too many declines making it difficult to grow the loan book?

NestEgg’s decision engine helps you navigate the cost of living crisis with inclusive & configurable credit decisions

Our new broker platform opens up access to affordable credit, helping responsible lenders grow their loan books

Inclusive lending

NestEgg is delighted to be a gold sponsor of the 2023 ABCUL conference in Manchester.

Our mission is to help individuals improve their financial health starting with affordable credit from responsible lenders who are looking to sustainably grow the loan book & member base.

Come and see us in the Trafford Room:

Don't take our word for it...

Our use of NestEgg has proved invaluable in assessing the affordability of any loan offer we make to a member and provides us with a tool to support the member by “nudging” them into better budgeting , helping them increase their credit score and providing a step on the path to financial stability.

Eileen Halligan, CEO Central Liverpool Credit Union

The decision engine

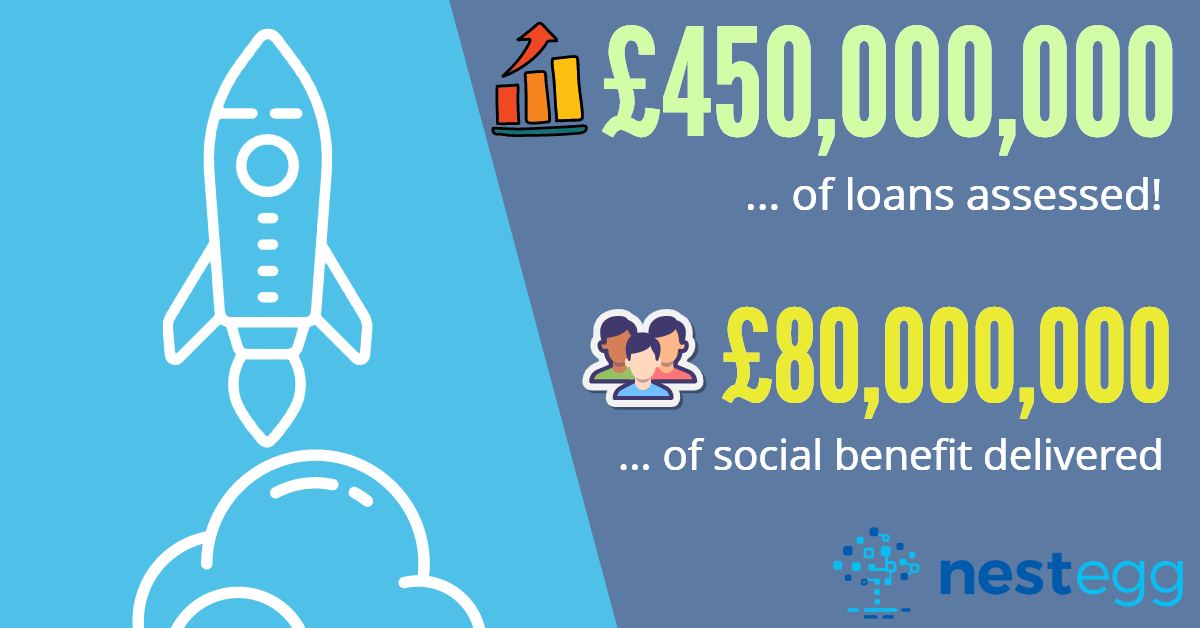

The NestEgg decision engine enables rapid loan book growth with quicker turnaround of fairer credit decisions and lower bad debt rates..

The decision engine provides:

The broker platform

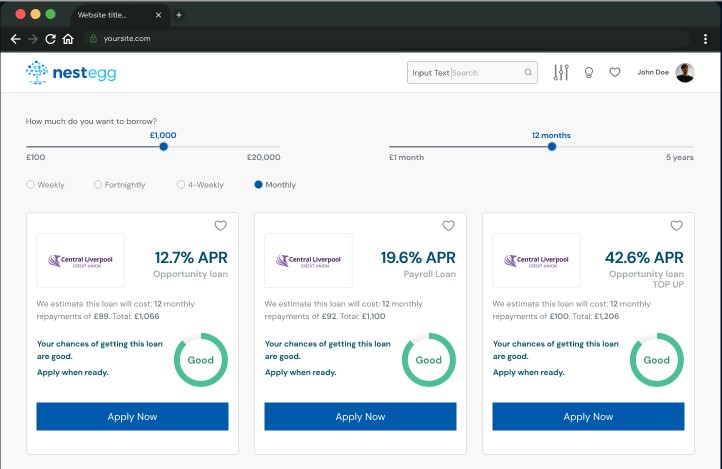

NestEgg provides one place for people to check whether they are eligible to join and qualify for loans from responsible lenders across the UK.

The platform provides soft credit checks and runs customised decision rules to see if the borrower meets your criteria to be accepted. If so, they can submit an application with one click.

How it works

1. Check to see which lenders you qualify for

Lenders typically have a membership qualification.

Lenders typically have a membership qualification.

For example, you must live in a certain area or work for a certain employer.

NestEgg quickly checks this. As a result, you can find the lenders that best match your personal circumstances.

2. See if which loans you would be accepted for

A soft credit check is undertaken to see if you’d qualify for loans from your chosen lender(s).

A soft credit check is undertaken to see if you’d qualify for loans from your chosen lender(s).

Importantly, this check has no impact on your credit score.

3. Apply

Loans are then sorted according to the likelihood that you’d be accepted. The loans with the lowest interest rate are shown first.

Choose a loan you know you’d be accepted for (green) or where you have a reasonable chance (amber).

4. Get tips and advice

If your chances are too low to apply, sign up for tips and advice. Our simple suggestions will help you improve your credit profile. As a result, you're more likely to be accepted next time.

Of course, even if your credit score is OK, there’s always room for improvement.