Payroll deduction allows employees to repay loans directly from wages before they hit their bank account. It’s a simple mechanism that can drive growth, provided the balance between risk and reward is struck. Importantly the data shows that a loan repaid via payroll isn’t a guarantee of success for either the lender (bad debt) or the borrower (poor outcomes).

At NestEgg, we’ve looked at 150,000 loan applications across the credit union sector over the last 12 months. The findings make a compelling case for putting payroll at the centre of credit union growth strategy. But it’s essential to find the right applicants. Without this, decline and bad rates can increase under the, sometimes, false assumption that payroll is always better.

Here are seven ways to make payroll lending more beneficial for both the credit union and borrower.

The Payroll Borrower

For this analysis we’ve mainly focussed on payroll deduction within geographical credit unions.

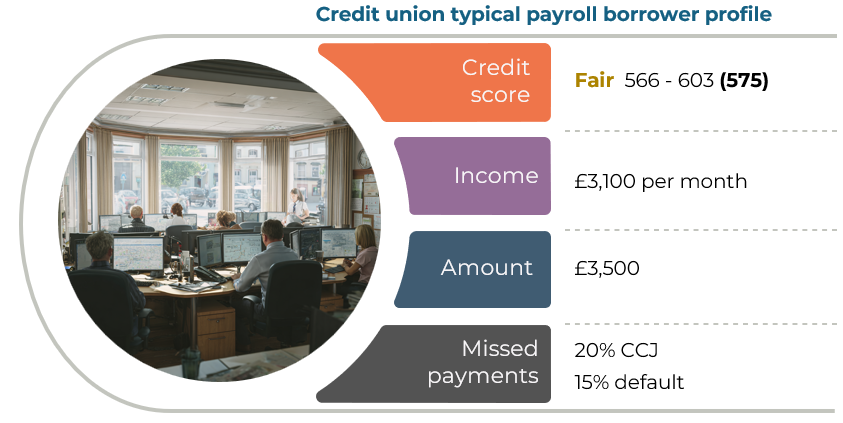

The typical payroll applicant has a fair credit score of around 575. One in five have a CCJ in the last six years. 15% have defaulted on a credit agreement. Mainstream lenders aren’t interested but without low-cost alternatives, employees end up with high-cost credit.

According to Fair4All Finance, payroll deduction “offers a tangible and scalable solution that could help divert households away from high cost credit and illegal forms of lending and into fair, responsible and affordable borrowing with credit unions.”

Payroll borrowers tend to carry higher credit card balances and are subject to more regular increases in limits. Buy Now Pay Later features with greatest frequency. One in four own their own home on a mortgage. The average payroll loan is £3,500 compared to £2,000 for standard credit union lending.

Around 10% of UK employees are in precarious employment. These workers are half as likely to be in unionised workplaces. Often these workplaces are where industrial credit unions started out; communication, distribution and public service. And the default rates are far lower for these workers, than those joining in less secure employment. Therefore, the difference isn’t just the payroll mechanism. It’s workforce tenure.

Recommendation 1: When evaluating payroll partnerships, prioritise employers with workforce stability over scale alone.

The defaults you’re not expecting

Payroll loans default at roughly half the rate of wider credit union lending. That’s partly explained by borrower mix: two-thirds of credit union (non-payroll) loans go to members with very poor credit scores. Payroll borrowers have slightly stronger profiles. But only just.

Whilst payment methodology is a significant contributor to reduced arrears, performance tracks credit profile. Borrowers with good or excellent scores have default rates below 1%. For fair scores (565-603), the rate can triple to 3%. Payroll deduction outperforms Direct Debit and Standing Order. However, default rates across all credit profiles are higher than many credit unions might assume.

Payroll deduction reduces credit risk. It doesn’t eliminate it. The payment mechanism is a powerful mitigant, but the underlying credit profile still matters.

Recommendation 2: Segment by credit profile. Maximise volume for good and excellent scores. For fair credit, lend confidently but provision for higher losses and consider tiered pricing.

The risk you’re Missing

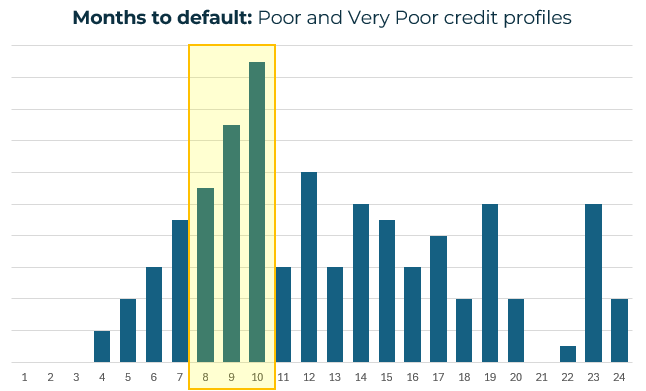

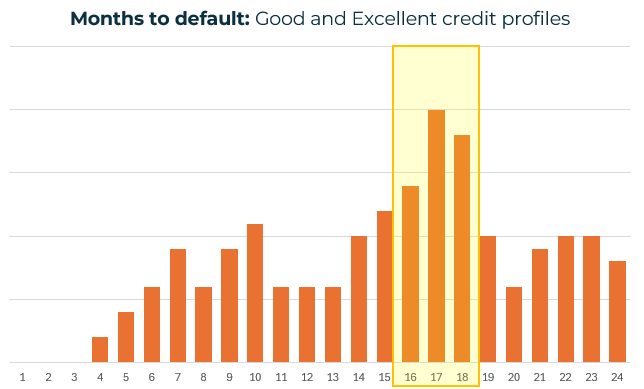

Most credit union loans fall into arrears within the first year. Underlying affordability issues may surface. However, the time taken for payroll loans to fall into arrears appears to be in line with credit score. Poor and very poor credit profiles default earlier, peaking around months 8-10. Good and excellent profiles default later, peaking around months 16-18.

The payment mechanism delays problems but doesn’t change the underlying dynamic: those with lower credit scores need support to keep them on track.

Recommendation 3: Time interventions. Monitor poor and very poor credit payroll loans closely in months 6-12 when risk peaks.

9x Safer: The Repeat Borrower Effect

First-time payroll borrowers have an average default and bad loan rate of 4%. Repeat borrowers have just 0.5%. Once someone successfully completes a payroll loan, they become nine times less likely to default on their next one.

Recommendation 4: Rate discounts after successful repayment are not just attractive, they’re a reward for being significantly lower risk.

4x Revenue. Same Effort.

Lifetime Value (LTV) measures the total interest income a member generates across their entire relationship. Not just one loan, but every loan they take.

A payroll borrower taking £3,500 at 12.7% APR over three years generates around £750 in interest. Three loans over nine years produces £2,250 in lifetime revenue.A family loan of £500 at 39.5% APR over twelve months generates around £100 per loan. Five loans over five years produces just over £500.

The family loan carrying an APR three times higher, the payroll borrower generates four times more revenue. After write-offs, the net return remains four times greater.

Of course LTV is a gross income. As a result it can mask the administration costs of lending that mean a £500 loan can barely break even. For the credit union movement to thrive, it needs longer-term loans (especially those on payroll)

Recommendation 5: Re-engage before payoff. Contact members 4-6 weeks before their loan completes with an invite for a soft check. Don’t wait for borrowers to go elsewhere.

Why good applicants drop out

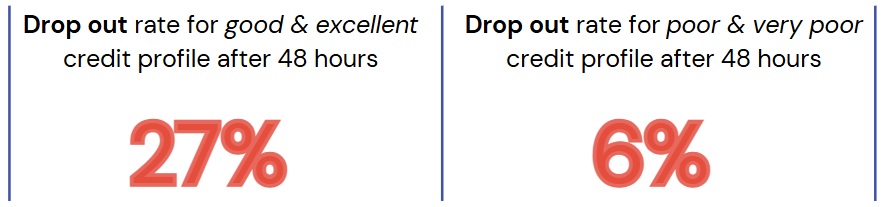

The better the credit score, the less patient the borrower.

Borrowers with good credit scores experience higher dropout and withdrawal rates. This is inevitably an outcome of having more choice. Without a soft credit check, conversion sits at around 30%. Soft checks before full application can more than double conversion.

Application processes that force a potential borrower to join the credit union before they can borrow significantly increase dropout. Those that make it through are much higher risk. Furthermore, forms that take two minutes attract applicants with credit scores 20 points higher than five-minute forms.

Recommendation 6: Use soft checks. Pre-qualify applicants before full application to filter out declines early and double conversion.

Recommendation 7: Simplify the journey. Let applicants join and borrow in one step.

Conclusion: 7 steps to better Payroll Lending

- Prioritise employers with workforce stability over scale alone. Job loss drive arrears.

- Segment by credit profile. Price for the borrower, as well as the payment mechanism.

- Monitor poor and very poor credit profile loans closely in months 6-12 when risk peaks. Intervene before they miss, not after.

- 9x safer. 4x lifetime value. Repeat borrowers deserve better rates – and they know it

- Contact members before their loan completes. Invite them to check their chances with a light touch application.

- Pre-qualify applicants beforehand. Soft checks increase conversion.

- Let applicants join and borrow in one step. Every extra step costs you the best applicants.

Payroll lending works. However, evidence is always better than assumed low risk. NestEgg helps credit unions build data-led payroll strategies. If you want to improve conversion, reduce defaults, and grow lifetime value, get in touch – let the data lead, not guesswork.

Book a demo now

Get insights into responsible lending

Enter your email to get insights once or twice a month

No spam. Unsubscribe anytime.