In 2025 lenders using NestEgg’s platform will prevent £250 million of financial harm affecting the top 20% most deprived areas.

This is possible due to NestEgg’s win at the FinTech Scotland’s Consumer Duty Challenge. The challenge has accelerated NestEgg’s Machine Learning so we can better identify vulnerable borrowers, and, of course, act on those findings.

Banks can be confident that when they refer declined loans to the NestEgg platform, our responsible partner lenders are addressing the Consumer Duty. We’re working together to ensure vulnerable customers receive the care and support they need.

The challenge

The Consumer Duty sets higher consumer protection standards. It requires financial firms to act in good faith, prevent foreseeable harm, and support customers’ financial goals. The FCA emphasises that firms must provide extra care to those in vulnerable circumstances to ensure fair treatment and good outcomes. However, it can be hard for banks to identify vulnerability. Therefore, it is harder to meet the four Consumer Duty Outcomes:

- Customer understanding: unstructured data may result in underestimating the number of vulnerable customers. As a result, foreseeable harm is more likely, however unintentional.

- Products and services: most banks’ products aren’t geared towards the needs of people looking to borrow smaller sums. Often declined on product qualification criteria alone, up to 3m vulnerable applicants may end up with an illegal money lender.

- Fair pricing: vulnerable individuals who keep up with credit payments may have lower scores than those who miss payments. Because most loans are priced by risk (based on credit score), fair pricing for vulnerable customers cannot be guaranteed.

- Customer support: if lenders aren’t always able to identify and understand vulnerability, provide the right products at the right price, it seems inevitable that it’s harder to provide effective support.

NestEgg specialises in helping vulnerable applicants looking for loans between £250 and £5,000. If you’re looking for a better route to ensure these customers are accessing the products and services they require, in a safe and regulated environment, talk to us about our award-winning Broker platform.

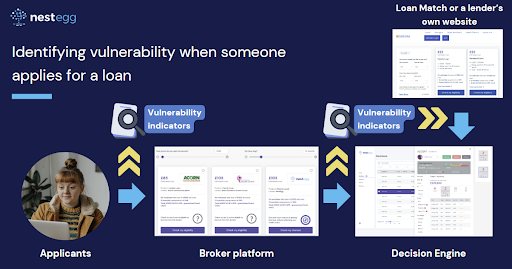

Identifying vulnerabilities

When someone applies for a loan using NestEgg’s loan matching service or Broker platform, (or a lender’s website), they share data with NestEgg and its lender partners. Machine learning models uncover hidden patterns of vulnerability. As a result, vulnerability assessment is deeper and more wide ranging. NestEgg captures vulnerable people that may otherwise have suffered financial harm.

Machine learning models uncover hidden patterns of vulnerability. As a result, vulnerability assessment is deeper and more wide ranging. NestEgg captures vulnerable people that may otherwise have suffered financial harm.

Improving outcomes

- Customer understanding: by identifying vulnerability during the application process, NestEgg lenders can be alerted to vulnerable borrowers to ensure appropriate support. In aggregate these data tell us much more about the characteristics of vulnerable borrowers. As a result, NestEgg lenders and referral partners have an unparalleled view of vulnerable borrowers.

- Products and services: where a bank is unable to lend (including because smaller value loans aren’t provided) applicants can confidently be referred to NestEgg knowing that the products and services provided by our partner lenders are designed to meet the needs of vulnerable groups.

- Fair pricing: we’ll be exploring the relationship between vulnerability and pricing to help lenders identify when an individual is vulnerable rather than a credit risk.

- Customer support: once vulnerable individuals are identified we can be more targeted with advice and tips to improve resilience. We’ll track outcomes and refer ‘double declines’ for tailored support.

Acting on vulnerability

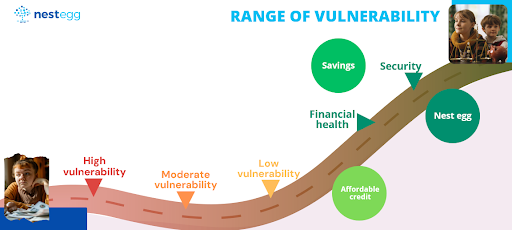

Although vulnerability can be transient or short-term, for many it is a long-term condition. However, by working together we can move people from vulnerability to resilience. Low income and credit score, health and poor housing contribute to vulnerability. Conversely access to insurance, payments, affordable credit, and savings contribute to building resilience.

NestEgg’s collaboration with credit unions fosters resilience through ‘save as you borrow’ schemes. These loan products encourage borrowers to save while repaying loans, transitioning from net debtors to net savers. Over time they built a nest egg and are more resilient.

Join us in Glasgow

On 3rd April 2025, we’re running a Vulnerable Borrower Summit in Glasgow. With speakers from the Financial Conduct Authority (FCA), Fintech Scotland, banks and credit unions we’ll be debating how best to improve outcomes for vulnerable borrowers.

Book a demo now

Get insights into responsible lending

Enter your email to get insights once or twice a month

No spam. Unsubscribe anytime.