For every thousand members, Canadian credit unions employ four to five staff. UK credit unions manage with roughly one, underscoring the importance of credit union automation.

That’s a striking gap. And in conversations with Canadian credit union leaders, we keep hearing the same frustrations behind it: loan decisions taking days or weeks. Business loans taking even longer. Back-office processes built on manual effort, and systems that require human intervention to connect, where credit union automation could serve as a solution.

The problem isn’t product complexity

Some of the staffing difference makes sense. Canadian credit unions are full-service financial institutions offering mortgages, commercial lending, wealth management, business banking, credit cards, and chequing accounts. UK credit unions typically focus on savings and personal loans. You’d expect Canadian operations to need more staff.

But product breadth doesn’t explain a fivefold difference. This is where credit union automation becomes essential.

The real issue is what happens after a member clicks “submit.” Most credit unions now offer some form of online loan application. However, accepting an application digitally is very different from processing it digitally. Industry research shows that while 90% of financial institutions have web-based applications, fewer than half can handle lending from application to funding without manual intervention. The form might be digital; the back office often isn’t, highlighting the need for credit union automation.

Personal loan decisions that could happen same-day stretch to several days. Mortgage applications that should close in weeks drag on for months. Each delay requires staff time, chasing documents, re-keying data, shepherding applications through disconnected systems.

The solution: automation that delivers visibility

At NestEgg, we’ve spent seven years helping 50 UK credit unions transform their lending operations through credit union automation. We saw the same patterns there before they embraced automation. And we’ve seen what changes when they do.

One credit union worked with NestEgg and doubled their loan book in two years after implementing automated decisioning. They moved from multi-day turnarounds to same-day decisions, without loosening credit standards.

Another credit union focussed on loan turnaround and halved the time taken to provide funds within two months.

Across our UK partners, we’ve processed over one million automated credit decisions. With Open Data, we’re seeing 30-40% more approvals for thin-file, newcomer, and younger applicants who would previously have been declined or stuck in manual review. Faster decisions. Lower cost per loan. Staff freed up for higher-value work due to credit union automation.

Benefits compound

The efficiency gains multiply in ways that directly address staffing pressures through credit union automation.

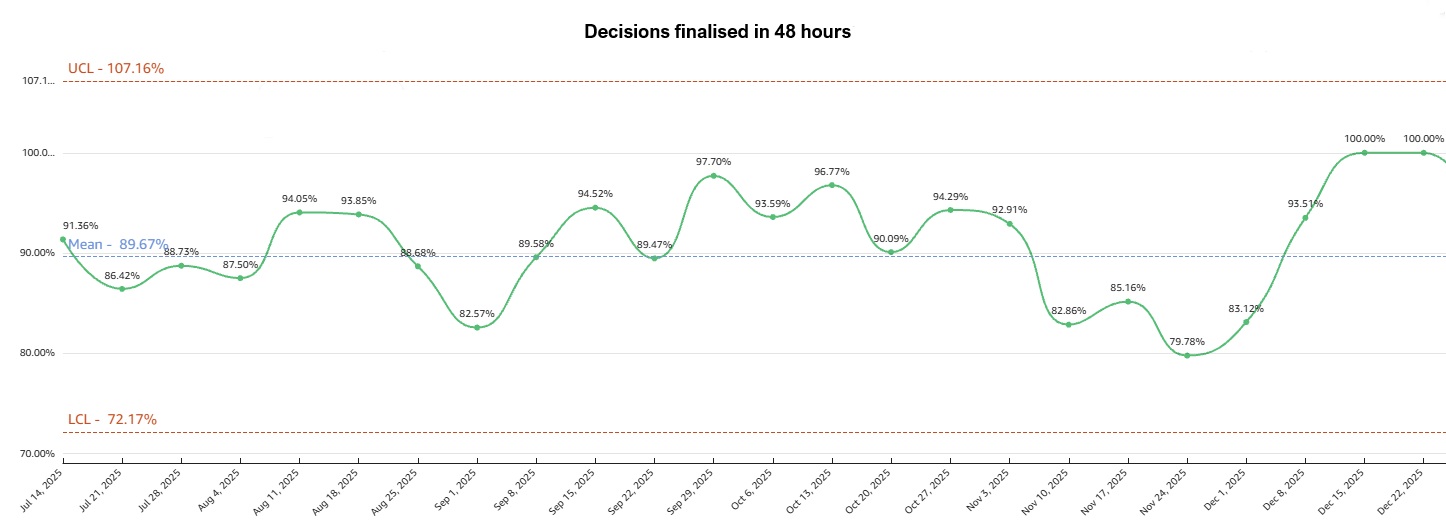

First, capacity scales without headcount. When a loan officer can process twice as many applications in a day, you don’t need twice as many loan officers as your book grows. One UK credit union now finalises nine in ten applications within 48 hours. Not by working harder, but by eliminating bottlenecks.

This credit union is now finalising all lending decisions within 48 hours

Second, automation delivers the visibility to improve systematically. When you can break turnaround time into its component parts – assignment time versus processing time – and measure each separately, improvement becomes targeted rather than guesswork. You discover that loan officers lose hours waiting for data without knowing it’s arrived. You learn that auto-approved loans actually run at half the bad rate of manually assessed ones, giving you confidence to automate more.

Third, for credit unions operating a centre of excellence model, automation makes centralisation actually work. The promise of a specialist lending team is consistency, compliance, and cost control. However, without granular data, those promises are hard to verify. Automated decisioning provides the evidence: every decision documented, every policy applied uniformly, every exception flagged and tracked. You can prove consistency rather than assume it, demonstrate compliance rather than reconstruct it, and reduce cost per decision rather than grow headcount.

The opportunity for Canadian credit unions

The 5x staffing gap between Canadian and UK credit unions reflects both legitimate product complexity and addressable operational inefficiency, which can be mitigated through credit union automation. The question is how much of that gap can be closed with automated decisioning.

As Consumer-Driven Banking takes shape from 2026, Canadian credit unions will soon have access to the same Open Banking data that transformed UK lending operations. The efficiency evidence is clear. The technology exists. The only question is how quickly Canadian credit unions can move to capture the gains UK counterparts have already demonstrated are achievable through credit union automation.

Resources for Canadian Credit Union Leaders

Stay informed about loan decisioning, member matching technology, and responsible lending innovations for Canadian credit unions

No spam. Unsubscribe anytime.