News

NestEgg announced as a finalist at the Consumer Credit Awards

NestEgg has been announced as a finalist for Technology Partner of the Year at this year’s Consumer Credit Awards, run by Smart Money People! This recognition highlights the growing impact of ethical technology in the credit sector and the amazing work our partners are doing to support financial wellbeing across the UK. Furthermore, this nomination…

Read MoreImproving outcomes for vulnerable borrowers

In 2025 lenders using NestEgg’s platform will prevent £250 million of financial harm affecting the top 20% most deprived areas. This is possible due to NestEgg’s win at the FinTech Scotland’s Consumer Duty Challenge. The challenge has accelerated NestEgg’s Machine Learning so we can better identify vulnerable borrowers, and, of course, act on those findings.…

Read MoreNestEgg joins the Financial Regulation Innovation Lab Consumer Duty Challenge

We’re thrilled to be part of the Financial Regulation Innovation Lab’s Consumer Duty Challenge. On 5 November, we joined other participants, industry partners, and experts in Glasgow to explore innovative solutions to address issues affecting both large and small financial institutions. The shared focus and fresh approaches revealed during the event were inspiring, providing valuable…

Read MoreNestEgg wins the Fast Solution award at the FCA TechSprint

NestEgg presented its Broker Platform at the FCA TechSprint last week, winning the Fast Solution’ award. The judging panel recognised the rapidity with which our platform can scale to connect declined borrowers to community finance. This means: A better decline journey for applicants Millions of pounds interest saved by borrowers living in the 20% poorest…

Read MoreNestEgg joins the FCA Financial Inclusion TechSprint

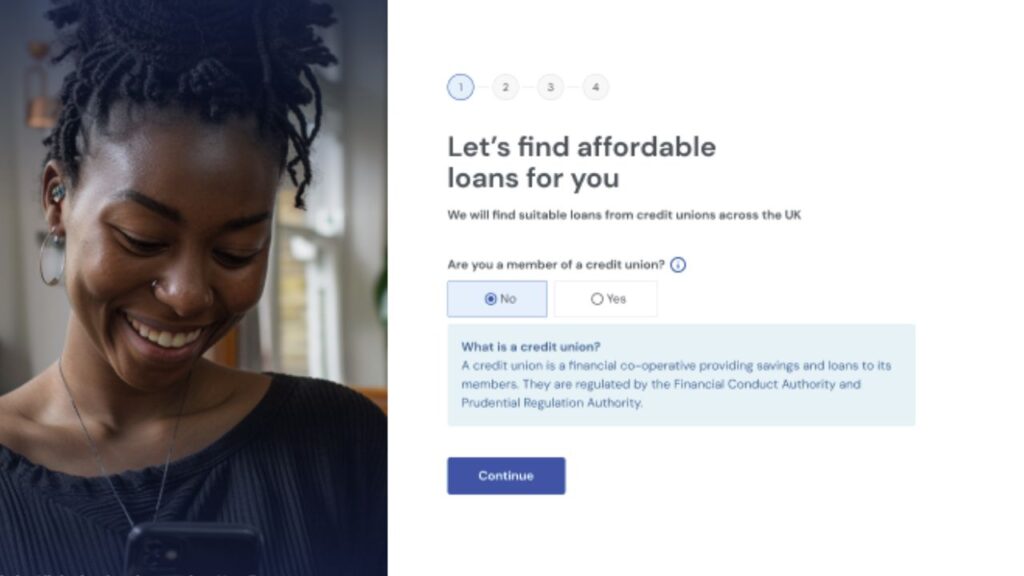

NestEgg is delighted to announce its participation in the FCA Financial Inclusion TechSprint. The TechSprint aims to utilise technology to boost the chances of loan approval and foster financial inclusion. The problem Our participation addresses two sides to the challenge. Firstly, people need help to find an alternative lender that is more likely to accept…

Read MoreNestEgg wins Innovate UK Grant

NestEgg has won a grant from Innovate UK’s Innovation in Financial Services Competition. The Innovate award recognises NestEgg as an innovative company that is improving the use of Open Finance. Open finance is the next iteration of Open Banking. In addition to connecting bank accounts, people can choose to share information about their assets including…

Read More