Cambrian Credit Union is a long-established lender with over 10,000 members. Its ‘common bond’ covers all of Wales.

- Introduced automated lending with the NestEgg Decision Engine at the end of March 2022

- Receive and decision applications through a third-party website and app, including using Open Banking

- Integrate* with the Progress Banking core system, eliminating the need to re-key information between systems

* NestEgg now integrates with most of the core systems used by the responsible lending sector. Contact us for details as we are constantly adding new ones.

"Our decision to work with NestEgg was key to growing our loan book, we have worked with NestEgg to improve our lending criteria making our lending more automated, giving a better customer journey"

Ann Francis CEO – Cambrian Credit Union

Over half of applications now arrive through the website with 40% via the app. Fewer than one in ten being made at branch or over the telephone, saving time and money

25%

Projected increase in loan applications during year 1

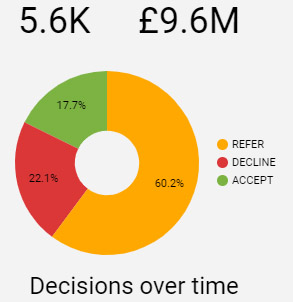

40% of applications are automatically accepted or declined.

Because of this loans officers only need to focus on 6 in 10 applications received, freeing up resources to support continued loan book growth.

Half of applications are decided within a few hours.

"NestEgg are a great company to work with. Their communication is excellent and they are always willing to help"

Ann Francis, CEO - Cambrian Credit Union

"I would recommend them to anyone looking for an innovative approach to lending."

Ann Francis, CEO - Cambrian Credit Union