Is demand for arrears grants running too high?

Instead of constantly bailing out customers in arrears, you can help them improve their financial wellbeing.

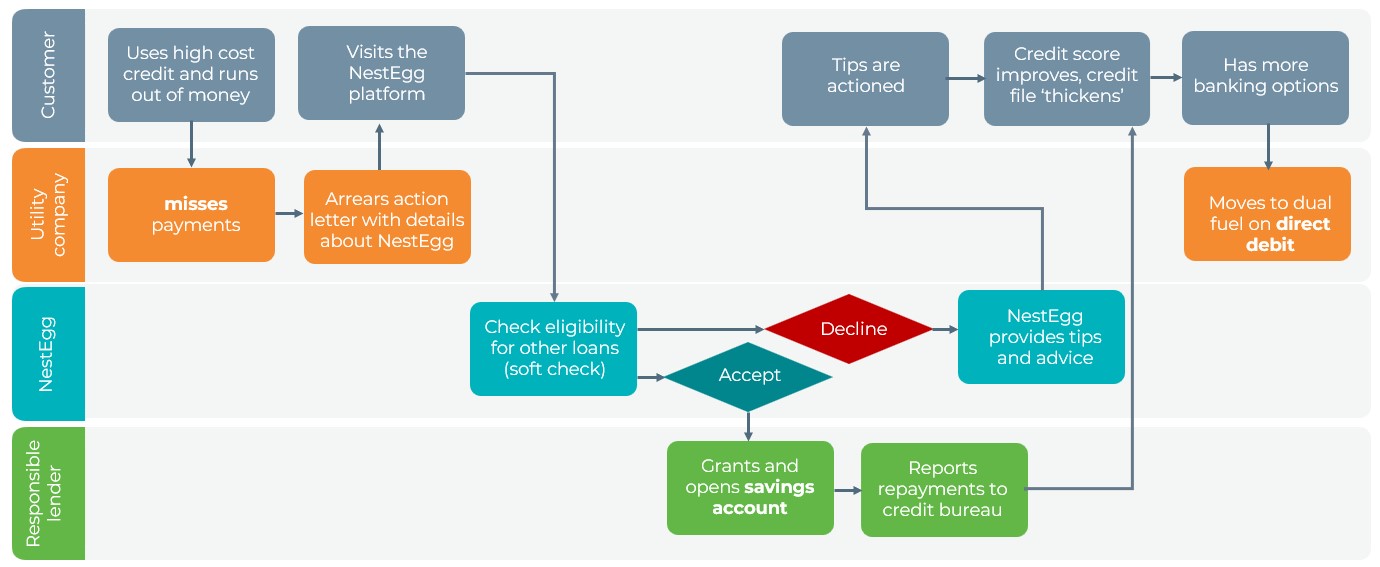

By referring your arrears customers to the NestEgg platform, they enhance their credit profile by receiving tips and advice and accessing affordable credit, if needed.

Improving the arrears journey, in this way, means that customers that may return for assistance are less likely to end up in arrears.

Inclusive lending

Community finance providers are good news for utility companies.

NestEgg’s platform helps lower-income households access affordable credit and safe savings.

By using responsible lenders people are less likely to get into arrears on their gas, electricity or gas bill.

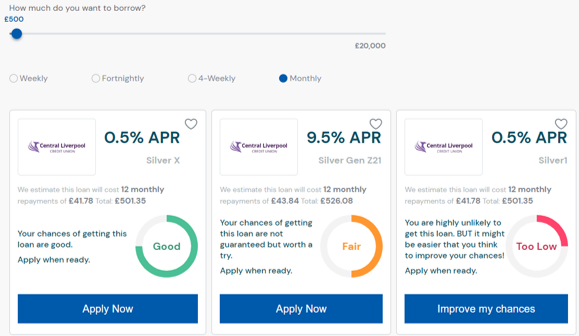

NestEgg provides one place for people to check whether qualify for loans from responsible lenders across the UK. The platform filters eligibility for joining and for loan products and provides soft credit checks. As a result, potential borrowers can see if they meet a lender’s criteria to be accepted for a loan. If declined, NestEgg provides bespoke tips and advice to help the applicant get accepted next time.

Don't take our word for it...

I had a child at a very young age. To support myself I took out a very large guarantor loan. But it ruined my credit file. Partly because it was a large loan and the repayments were high. It made me look like I had too much debt. The interest rate was so high. I ended up paying back double.

Because I didn’t want my credit score to get any worse, I did everything I could to repay the loan without missing a payment. But this meant that I’d skipped on other bills – like water, gas and electricity. Because of that, my credit score did fall anyway.

NK, Member of Central Liverpool Credit Union

How it works