Want to grow the loan book even faster?

Looking for more straight through accepts?

Need a better way to handle declines?

The NestEgg platform only sends you loans that you are almost certain to accept.

By referring your declined members to the NestEgg platform, they enhance their credit profile by receiving tips and advice and accessing affordable credit, if needed.

Improving the decline journey, in this way, means previously declined members will return to your credit union and qualify for a loan.

Inclusive lending

NestEgg’s new platform opens up access to affordable credit, helping responsible lenders grow their loan books.

Credit unions could grow so much more quickly, they just need to make themselves easier to find and apply to. By doing so, more members can benefit from access to fairer credit and safe savings during difficult economic times.

The platform provides soft credit checks and runs customised decision rules to see if the borrower meets your criteria to be accepted. If so, they can submit an application with one click.

If an application is declined for a particular product, NestEgg presents alternative options. If none are available, the applicant is provided with bespoke tips and advice to help them get accepted next time.

To boost take-up, NestEgg will receive referrals from dozens of external organisations, like housing associations, banks, building societies and others interested in promoting financial inclusion.

Don't take our word for it ...

Users received emails with tips. They described tips that were written in plain English and without jargon. They commented that the tips have been helpful, particularly around managing their credit score. They also felt that the tips let them put in place small strategies that were manageable and achievable.

“This is good advice and ideas on what to do.”

“Nest Egg made me put things in perspective and see reality: I was reckless with my money before—now I will think before I spend.”

“I am making better informed choices.”

“This is the best advice: precise, I can understand, I can follow a process to sort things--I am really pleased.”

Feedback from an independent review carried out by Enabling Outcomes

How it works

1. Members check to see which lenders they qualify for

NestEgg quickly checks your common bond criteria, including living or working in a particular area, working for a specific employer or being a tenant of a Housing Association.

The platform also reviews which loan products are suitable, for example those based on membership criteria, family or payroll loans.

2. See if which loans you would be accepted for

A soft credit check is undertaken to see if the potential member would qualify for a loan from their chosen lender(s).

A soft credit check is undertaken to see if the potential member would qualify for a loan from their chosen lender(s).

Importantly, this check has no impact on their credit score.

3. Apply

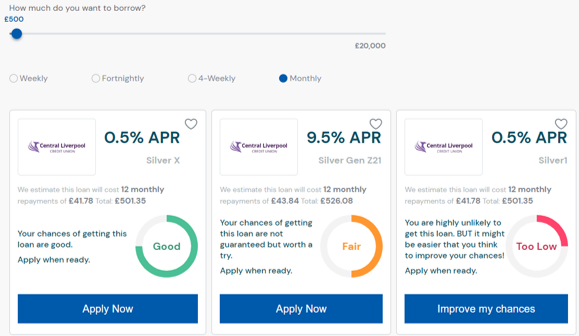

Loans are then sorted according to the likelihood that the applicant would be accepted. The loans with the lowest interest rate are shown first.

The applicant can choose a loan they know you’d be accepted for (green). You can also receive referrals for 'refers' where there is a reasonable chance that the loan would be accepted.

4. Get tips and advice

If the applicant's chances are too low to apply, they can sign up for tips and advice. NestEgg's simple suggestions will help the applicant improve their credit profile. As a result, they're more likely to be accepted next time.

Of course, even if the credit score is OK, there’s always room for improvement.