Cambrian Credit Union is good news for tenants

NestEgg and Cambrian Credit Union are working together to help tenants avoid getting into arrears.

By accessing affordable credit, tenants are less likely to spend money servicing high cost interest payments or use your rent as an interest free loan.

Inclusive lending

NestEgg provides one place for people to check whether qualify for loans from responsible lenders across the UK.

And the service is much needed:

The free-to-use platform filters eligibility for loans. As a result, the options available for people on lower incomes are increased.

Consequently, potential borrowers can see if they meet a lender’s criteria to be accepted for a loan. Next, an application can then be submitted with just one click.

Importantly, if declined for a loan, NestEgg provides bespoke tips and advice to help the applicant get accepted next time.

Don't take our word for it...

Even though I'm going through tough times at the moment ... missing payments, being in arrears, which never happened to me before, they still try to help me in any way they can

Modou Bah, Member of Cambrian Credit Union

I lost my job recently after never being out of work and the cost of living going up I had no choice but to sign on to benefits but that was still a struggle. Someone suggested Cambrian Credit Union so I looked into it. It was easy to set up all online when I struggled with documents and had to ring up staff were very helpful and polite no judgement. I would highly recommend. I'm really thankful of the company

Member of Cambrian Credit Union

Borrow less, save more

Of course, savings play an important role.

Although the Financial Conduct Authority found that 13% of households had no savings at all, this leapt to 80% amongst social tenants and 40% amongst private renters.

Furthermore, three quarters of people borrowing from high cost lenders had no savings.

Therefore, there’s a clear link between having no savings and using higher cost credit.

With 1 in 10 renters having arrears, the cost of an eviction estimated at £23,000 and the cost of living crisis biting, NestEgg’s platform couldn’t have come at a better time.

This is a great opportunity to support tenants, with clear benefits for landlords.

Finding an affordable loan

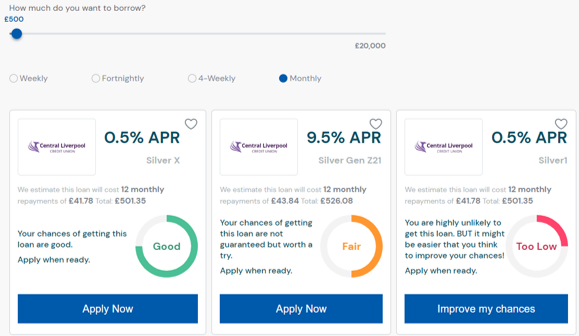

1. Check to see which lenders you qualify for

Lenders typically have a membership qualification.

Lenders typically have a membership qualification.

For example, you must live in a certain area or work for a certain employer.

NestEgg quickly checks this. As a result, you can find the lenders that best match your personal circumstances.

2. See if which loans you would be accepted for

A soft credit check is undertaken to see if you’d qualify for loans from your chosen lender(s).

A soft credit check is undertaken to see if you’d qualify for loans from your chosen lender(s).

Importantly, this check has no impact on your credit score.

3. Apply

Loans are then sorted according to the likelihood that you’d be accepted. The loans with the lowest interest rate are shown first.

Choose a loan you know you’d be accepted for (green) or where you have a reasonable chance (amber).

4. Get tips and advice

If your chances are too low to apply, sign up for tips and advice. Our simple suggestions will help you improve your credit profile. As a result, you're more likely to be accepted next time.

Of course, even if your credit score is OK, there’s always room for improvement.