It’s now easier to meet your duty of care towards vulnerable members

Instead of disappointing a declined member, you can help them improve their financial wellbeing.

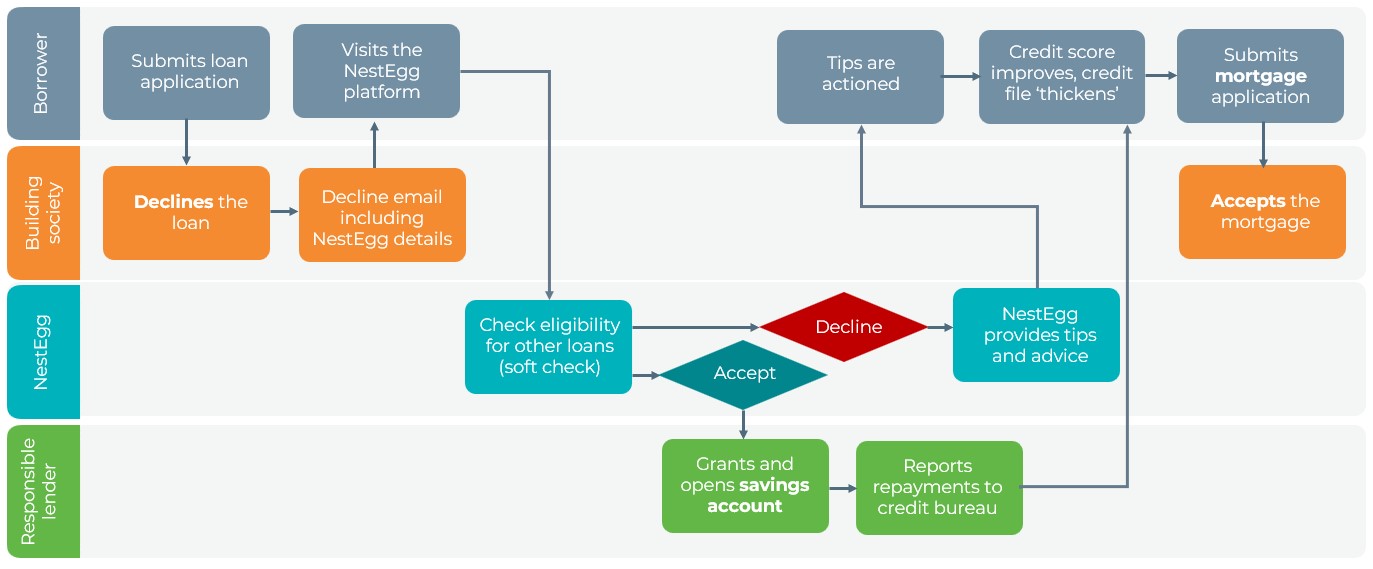

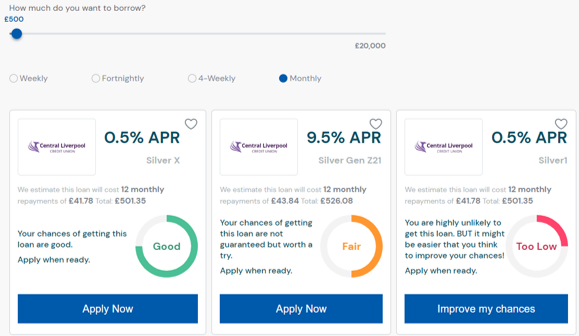

By referring your declined and potentially vulnerable members to the NestEgg platform, they enhance their credit profile by receiving tips and advice and accessing affordable credit, if needed.

Improving the decline journey, in this way, means previously declined members can avoid using high cost credit and are more likely to return to your building society and qualify for a mortgage in the future.

Inclusive lending

Saying ‘no’ to members is hard.

Borrowers may consider a mortgage as an essential way for them to meet their financial goals. Because of this, a decline decision will result in disappointment or even a complaint. To make matters worse, it’s hard to tell a member why exactly they’ve been turned down for a home loan.

Declined applicants can get a loan, pay it back, improve their credit score and ‘thicken’ their credit report.

Consequently, the credit risk falls and they may qualify for a mortgage from a building society in the near future.

Don't take our word for it...

I'm generally on top of my credit score and it's pretty high. But it's not good enough for some lenders and this is an issue for me because I need to re-mortgage. The rates are increasing and I'm in a hurry to get the best deal. I can improve my credit score, but one way to get it even higher was to pay back my credit union loan. Because of the new repayment record I was able to re-mortgage at a good rate.

CM, Member of Central Liverpool Credit Union

How it works