We’ve taken a look at five credit unions using the NestEgg Decision Engine and Workflow to understand how credit unions are helping with the Coronavirus. The surge in Coronavirus-related loan applications is huge.

We estimate that at least £4 in every £10 borrowed, since lockdown, is supporting members suffering because of Coronavirus.

What is Coronavirus related expenditure?

We’ve made some assumptions. During lockdown people want to make their homes more comfortable and therefore borrow for home improvements. For similar reasons borrowers may also want new household equipment. Most obviously a loan to make up for lost income or to be able to afford to bulk buy food. These assumptions are backed up by the qualitative information provided in applications from a sample of members.

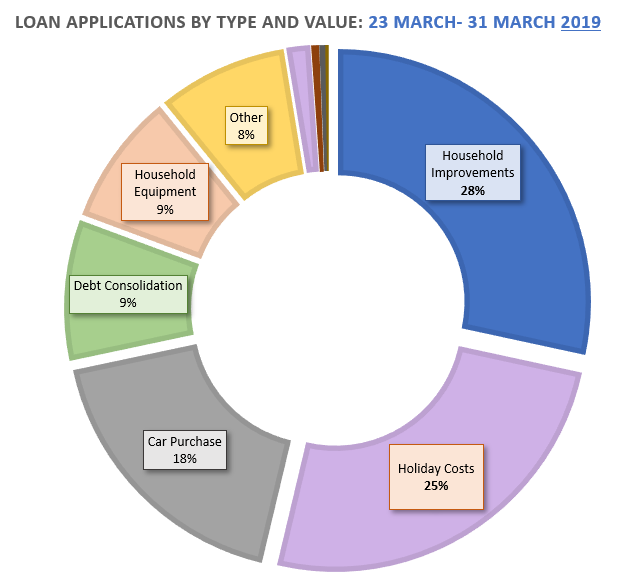

Typical borrowing patterns BEFORE Coronavirus

Here’s the picture for this time last year year:

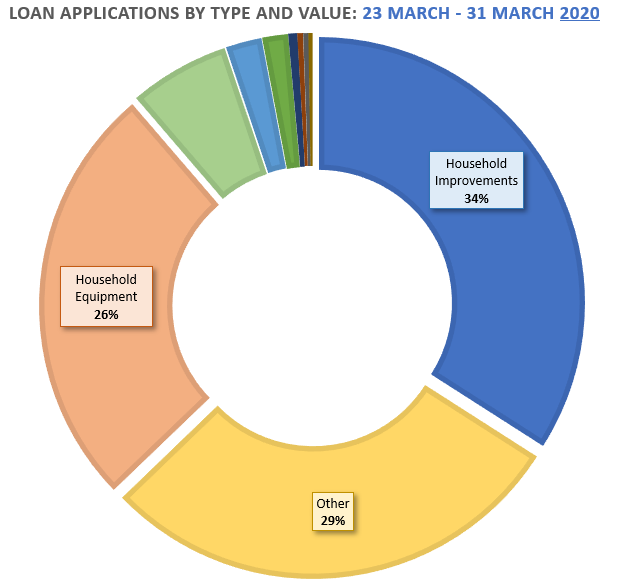

Typical borrowing patterns AFTER Coronavirus

Over the last week (24 March to 31 March), we’ve seen big increases in applications for household improvement (up by 6%), household equipment (up by 17%) and ‘other’ (up by 21%):

Early conclusions

We’re only one week in, but the pattern is clear; almost 90% of loan applications are about the household or emergency (other) needs. That’s a 44% increase compared to the average.

Therefore at least £4 in every £10 lent is for the Coronavirus. But this could be much higher. Credit unions are helping with the Coronavirus. There’s more than £1m of loans included in the figures above.

Social return

This lending has a huge social impact. 85% of borrowers were in the bottom quintile credit score distribution. Compared to using a high cost lender we estimate that in one week alone these credit unions created a social dividend of more than £500,000.

Credit unions are providing a lifeline during the Coronavirus. But they face challenges. The government needs to recognise the role played by non-profit lenders. It needs to be prepared to fund lending and institutional capital so responsible lenders can help more people during these difficult times. The impact is proven. And it helps the most vulnerable.

We’ll be back soon with more in-depth research. Follow us on LinkedIn. Contact us for a demo of our software and analytics.

Book a demo now

Get insights into responsible lending

Enter your email to get insights once or twice a month

No spam. Unsubscribe anytime.